The Specified Undertaking of Unit Trust of India (Suuti) has invited merchant bankers to help it sell stakes in 51 companies.

The total value of these holdings, which includes 43 listed firms and eight unlisted ones, is likely to touch Rs 60,000 crore.

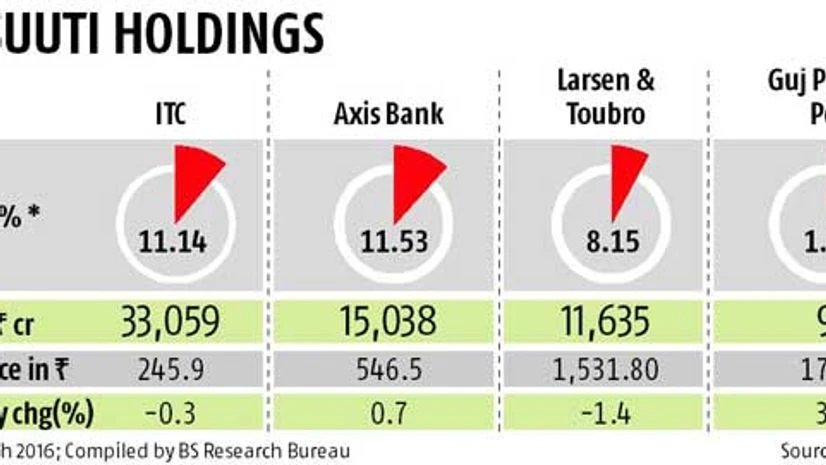

The bulk of the value resides in three blue-chip companies, Larsen & Toubro, ITC and Axis Bank. At Friday’s close, the value of these three holdings stood at Rs 59,732 crore.

Amid expectations of a huge supply and implications for management, L&T (-1.4 per cent) and ITC (-0.3 per cent) ended in the red, while Axis Bank gained 0.7 per cent on a day when the Sensex declined 0.27 per cent.

The other listed companies Suuti holds stakes in include Reliance Industries, Hindustan Unilever, Ambuja Cements, HERO Motocorp, Tech Mahindra, Tata Steel, Tata Power, Tata Motors, BPCL, Ultratech Cement, Sun Pharmaceuticals and Videocon Industries. Most of these holdings are less than 1 per cent and do not reflect in quarterly filings of the companies. But Suuti owns majority stakes in some unlisted companies like UTI Advisory Services and UTI Infrastructure Technology.

“Companies like ITC, Axis Bank and L&T are well known and the sale may present a good opportunity for long-term institutional shareholders to acquire large stakes at a fixed price. I expect investors to bid aggressively,” said Prithvi Haldea, founder, Prime Database, a primary market tracker.

Suuti was a limited purpose body formed in 2003 to administer redemptions to investors of assured return schemes of the erstwhile Unit Trust of India.

Although it had settled most of its liabilities by 2008-09, attempts to liquidate it have been stuck for several years. In 2014, Suuti had offloaded around 9 per cent in Axis Bank for Rs 5,500 crore. JP Morgan, Citigroup and JM Financial were bankers for the sale. ICICI Prudential was tipped to be the asset manager for a proposed exchange traded fund, which was shelved, as was a proposal to move the assets to a separate holding company.

“This should have been done long back. The government cannot hold on to these stocks forever. I don’t think you need to worry about the market impact as bankers can advise Suuti to take up strategic sales. That way there will not be a big supply,” said stockbroker Deena Mehta.

The various methods listed in the request for proposals include offer for sale, block deal, bulk deal, regular sale through stock exchanges, or any other mechanism subject to guidelines of the Securities and Exchange Board of India (Sebi).

Suuti wants bankers appointed to make efforts to ensure retail participation in the sale.

A plan of action is to be submitted on each responsibility and the task to be undertaken by the selected merchant banker in connection with the captioned sale in respect of the companies constituting Suuti Holdings. Suuti has reserved the right to study this plan and suggest changes.

A Suuti executive told Business Standard, the 13-year-old entity would proceed according to the process laid out in the request for proposals. He declined to comment on any preferred method.

Suuti expects the process to be drawn out and wants to appoint three merchant bankers for up to three years.

“Block trades will be the most suitable way of offloading these stocks, but the government will look at offer for sales as well. The success of the sale will depend on two factors: demand from investors and liquidity in the specific stocks,” an investment banker with a domestic securities firm said.

One eligibility condition for applicants is that they should have handled at least one issue of Rs 1,000 crore in the past three years. “The condition will ensure only big merchant bankers participate. The three-year lock-in period will not be a constraint for banks that have adequate manpower,” the investment banker added.

Between April 1, 2013, and June 30, 2016, there were 17 share sales of Rs 1,000 crore or more, according to Prime Database. Eleven foreign investment banks and nine local ones participated in these issues, meaning 20 investment banks are eligible for participating in the Suuti sale.

In the past, bankers have bid aggressively for public sector divestments because these boost their positions in league tables. There are several instances where bankers have bid at near zero levels, making analysts question their commitment and ability to deploy adequate resources to execute the mandate.

“Every bank has its own methodology to determine which mandate it wants to be part of. Some base their decision on fees while others look at league table rankings. The government will ideally seek to appoint a mix of foreign and domestic investment banks. Foreign banks, however, may be constrained to commit resources for three years,” said a source who did not wish to be named.

Several foreign investment banks have cut personnel by 30-50 per cent over the past few years and have become picky about deals. The stake sale could also be challenging if done through baskets that include a mix of good and bad scrips.

Selected merchant bankers will have to submit to Suuti a separate list of institutional and other major investors, both domestic and international, to be approached for sale of companies constituting the Suuti Holdings.

Strategic divestment in PSUs within 6 months: Panagariya

The government is expected to go ahead with the strategic divestment in public sector units (PSUs) within the next six months besides closing down sick firms that are beyond revival, NITI Aayog Vice-Chairman Arvind Panagariya said.

“On strategic divestment, you will see action in the next six months I would say, meaning that the process is on, but you will see some action happening in the next six months or less,” he said.

NITI Aayog has been tasked by the government to identify central public sector enterprises (CPSEs) for strategic disinvestment. The task also involves advising on the mode of sale, percentage of CPSE shares to be sold and method for valuation of the unit.

)