Gold refineries shutting bulk operations

Supply through recycling of used gold declined to around 10 tonnes in the second quarter of the current calendar year

)

India’s gold refineries are operating, says the trade, at only 25 per cent of installed capacity due to acute shortage of used jewellery.

“There was no gold import in the last two months. Hence, the domestic demand, albeit weak, was met only through existing inventory and recycled gold. But with the stagnation in gold price, scrap sales have declined dramatically in the last few weeks, posing a threat for refineries,” said James Jose, vice-president of the Association of Gold Refineries and Mint, and managing director of Chemmanur Gold Refinery.

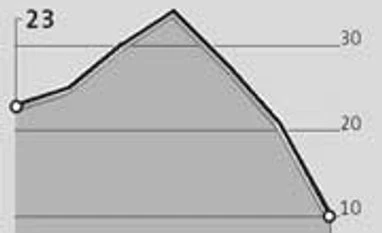

Supply through recycling of used gold declined to around 10 tonnes in the second quarter of the current calendar year. In the third quarter, supply through used gold is estimated to be further down, resulting in lower availability of scrap for recycling.

Refineries will have to shift to processing of dore, the cast bar from the first stage of gold purification; it is about 90 per cent gold. The government liberalised dore (pronounced do-ray) import early this year and this has become more economical than buying pure gold from foreign refineries. However, procedural hurdles have meant refineries have not shown much interest in importing dore. A licnece to do so is needed from the directorate general of foreign trade. Refineries will, however, have to shift to doing so, said Jose.

“The government since the beginning of this year has taken several steps to curb gold import, resulting in lower availability of virgin gold. In addition to increasing the import duty to 10 per cent, it mandated a minimum 20 per cent of imported quantity to supply jewellery exporters. This has created an impression in the minds of consumers that gold supply will remain under severe stress. Consequently, consumers currently abstain from disposing gold jewellery, resulting in reduced supply of used gold. The trend is likely to continue in the fourth quarter as well,” said Somasundaram PR, managing director (India) of the World Gold Council.“There was no gold import in the last two months. Hence, the domestic demand, albeit weak, was met only through existing inventory and recycled gold. But with the stagnation in gold price, scrap sales have declined dramatically in the last few weeks, posing a threat for refineries,” said James Jose, vice-president of the Association of Gold Refineries and Mint, and managing director of Chemmanur Gold Refinery.

Supply through recycling of used gold declined to around 10 tonnes in the second quarter of the current calendar year. In the third quarter, supply through used gold is estimated to be further down, resulting in lower availability of scrap for recycling.

Refineries will have to shift to processing of dore, the cast bar from the first stage of gold purification; it is about 90 per cent gold. The government liberalised dore (pronounced do-ray) import early this year and this has become more economical than buying pure gold from foreign refineries. However, procedural hurdles have meant refineries have not shown much interest in importing dore. A licnece to do so is needed from the directorate general of foreign trade. Refineries will, however, have to shift to doing so, said Jose.

Normally, scrap supply goes up in a free market. Since the government has put a curb on gold import, supply of virgin metal will remain under stress, translating to similar stress on scrap sales. Consumers will hold gold ornaments, assuming further supply tightening might create a real shortage of the yellow metal.

“Lots of consumers are currently focusing more on exchange of gold ornaments than purchasing all-new items. A small portion of the exchanged ornaments, especially the hallmarked ones, come back for direct sales after polishing; the larger portion still goes for melting in refineries. But sales of used gold remain low due to stagnation in prices,” said Haresh Soni, chairman of the All India Gems and Jewellery Trade Federation.

Overall consumer sentiment is weak in the jewellery markets. For a recovery in sales of ornaments and re-sale as scrap, the sentiment has to improve through proper policy support from the government, said Soni.

“Gold refineries are on the verge of closure due to non-availability of used jewellery. Melting of jewellery scrap to convert into 24-carat gold has, therefore, become a loss-making process and operational capacity has declined to an alarmingly low level,” said Harmesh Arora, managing director of NIBR Bullion.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 09 2013 | 10:34 PM IST