IndiGo: A robust business model but no discount in IPO price

While there is little doubt about the company's capability to deliver, the pricing could have been more attractive

)

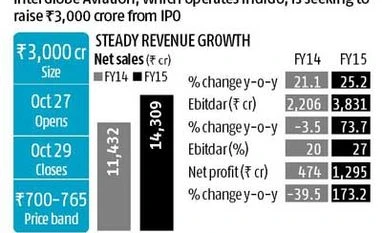

India's largest airline company, InterGlobe Aviation, which operates IndiGo, is seeking to raise about Rs 3,000 crore from its initial public offering (IPO). While about Rs 1,800 crore of this is an offer for sale, going to the existing shareholders, the rest is a fresh issue. At Rs 765, upper end of the band, the company is looking at a valuation of Rs 27,500 crore. The two listed aviation players, Jet Airways and SpiceJet, have a combined market cap about a fourth of this number.

Why IndiGo is asking for a higher valuation is due to a consistent record of superior operational performance, across parameters. The key differential is, of course, the way it manages costs. Costs per available seat km (CASK, measured in US cents) at 5.95 is much lower than SpiceJet's 6.68 and Jet Airways' 9.05. Excluding fuel, the single biggest cost item, its CASK at 2.87 cents is lower than GoAir and SpiceJet, the other low-cost carriers. A single aircraft type, low distribution costs and a younger fleet have helped keep down costs on operations and maintenance. Its decision to order 100 A320s in 2005 helped it negotiate favourable terms, analysts say. The sale-and-lease back arrangement helped it gain about Rs 3,500 crore.

Coupled with the fleet expansion and strong passenger volumes, the low CASK has helped it grow faster than the market. IndiGo's market share has increased from 14.5 per cent in FY10 to about 36 per cent with passenger volumes increasing 26 per cent. Higher volumes and load factors, along with growing revenue per passenger, has translated to 40 per cent annual growth in domestic revenues over FY10-15, while earnings before interest, taxes, depreciation, amortisation and rentals (Ebitdar) have grown 25 per cent. The company has also benefited due to the multiple challenges faced by competition (management change, high cost structure, lack of pricing discipline, etc.), which helped IndiGo move ahead.

A few favourable tailwinds will benefit the entire sector going ahead. The first is passenger volumes. The sector has been growing at about 12 per cent annually and analysts say demand would be 1.2-1.5 times gross domestic product growth which should help all players. Especially IndiGo, given its fleet strength and the fact that it is growing faster than the market. Growth in recent months has been a strong 20 per cent for the sector, with IndiGo outperforming peers. The other positive for the company is cheaper fuel costs which should boost its profits.

In FY15, the company made Ebitdar margins of 27 per cent and net margins of nine per cent as compared to 20 per cent and four per cent in FY14. Ebitdar margins, given lower fuel costs, spurted to 37 per cent in the June quarter, with net margins at 15 per cent enabling the company to report a net profit of Rs 640 crore. While the September quarter and the March quarter are not the best quarters of the year, analysts believe the company should be able to close the year at about Rs 2,400 crore in net profits.

The listed players far lag IndiGo and have a patchy net profit record; so, a comparison with the better global performers is in order. Low cost European and American carriers have their enterprise value/Ebitdar ranging between seven and eight times. While the company deserves a higher multiple given that the Indian market is growing faster, the IndiGo IPO, at about 7.6 times its FY16 EV/Ebitdar estimates, is slightly on the expensive side. Analysts say the company should have left something on the table for investors.

Why IndiGo is asking for a higher valuation is due to a consistent record of superior operational performance, across parameters. The key differential is, of course, the way it manages costs. Costs per available seat km (CASK, measured in US cents) at 5.95 is much lower than SpiceJet's 6.68 and Jet Airways' 9.05. Excluding fuel, the single biggest cost item, its CASK at 2.87 cents is lower than GoAir and SpiceJet, the other low-cost carriers. A single aircraft type, low distribution costs and a younger fleet have helped keep down costs on operations and maintenance. Its decision to order 100 A320s in 2005 helped it negotiate favourable terms, analysts say. The sale-and-lease back arrangement helped it gain about Rs 3,500 crore.

A few favourable tailwinds will benefit the entire sector going ahead. The first is passenger volumes. The sector has been growing at about 12 per cent annually and analysts say demand would be 1.2-1.5 times gross domestic product growth which should help all players. Especially IndiGo, given its fleet strength and the fact that it is growing faster than the market. Growth in recent months has been a strong 20 per cent for the sector, with IndiGo outperforming peers. The other positive for the company is cheaper fuel costs which should boost its profits.

The listed players far lag IndiGo and have a patchy net profit record; so, a comparison with the better global performers is in order. Low cost European and American carriers have their enterprise value/Ebitdar ranging between seven and eight times. While the company deserves a higher multiple given that the Indian market is growing faster, the IndiGo IPO, at about 7.6 times its FY16 EV/Ebitdar estimates, is slightly on the expensive side. Analysts say the company should have left something on the table for investors.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 22 2015 | 11:19 PM IST