The Securities and Exchange Board of India’s (Sebi) move to raise the minimum public shareholding in government-run companies to 25 per cent can drive more retail investors to the capital market, experts say.

Small investors and those who became averse to equities’ investing after the 2008 stock market crash, could be more than willing to participate in future divestments following an improvement in sentiment towards public sector undertaking (PSU) stocks, they said.

Also, attractive gains in some of the recent government disinvestments, such as Power Grid, Engineers India and the CPSE exchange traded fund, could encourage new investors.

“There will be enough appetite for share sale of PSUs. These companies already being listed, their performance and quality is already known to the market. Retail investors will invest aggressively if the new government also continues to offer additional 10 per cent discount,”said Prithvi Haldea, chairman, Prime Database.

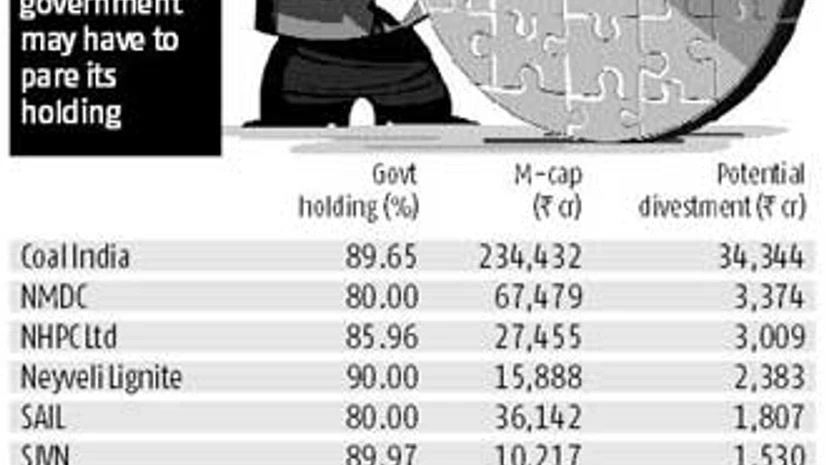

Capital market regulator Sebi has written to the finance ministry, proposing a mandatory public float in PSUs of at least 25 per cent from the current 10 per cent. The proposal, if accepted, will see the government divesting stakes worth Rs 55,000 crore in 30 companies where it currently has more than 75 per cent stake.

“Historically speaking, PSU disinvestment in India has triggered a huge wave of new investors to enter the capital markets through Initial Public Offers (IPOs). The Coal India IPO alone has brought several lakhs of new investors into the markets,” said Jagannadham Thunuguntla, head of research, SMC Global Securities.

The Rs 15,000-crore IPO of Coal India in 2010 had attracted 1.7 million retail applications. The follow-on public offers (FPOs) of Engineers India and Power Grid in 2013-14 saw encouraging retail participation.

Some of the major companies where the government will have to divest to bring down its holding to 75 per cent include Coal India (where it will have to sell shares worth Rs 34,000 crore at the current market rate), NMDC (Rs 3,373 crore) and NHPC (Rs 3,009 crore).

Experts said the government should opt for the FPO route to sell shares in these companies to promote retail participation. They should drop the faster and easier Offer For Sale (OFS) route, which primarily suits institutional investor participation, they said.

“Considering financial inclusion and deepening the penetration of the capital market products are on the radar of the new government, it might be critical to continue the PSU disinvestment programme,” said Thunuguntla.

That apart, the move to align the public holding in PSUs with that in private companies is a right step towards levelling the playing field, said corporate governance structure experts, advocating a uniform set of rules for all listed companies.

“More public holding in PSUs will make the companies less volatile and susceptible to manipulation. The governance structure of public companies would need to be beefed to meet the expectations of retail investors,” said Amit Tandon, managing director, Institutional Investor Advisory Services, a proxy advisory and corporate governance firm.

)