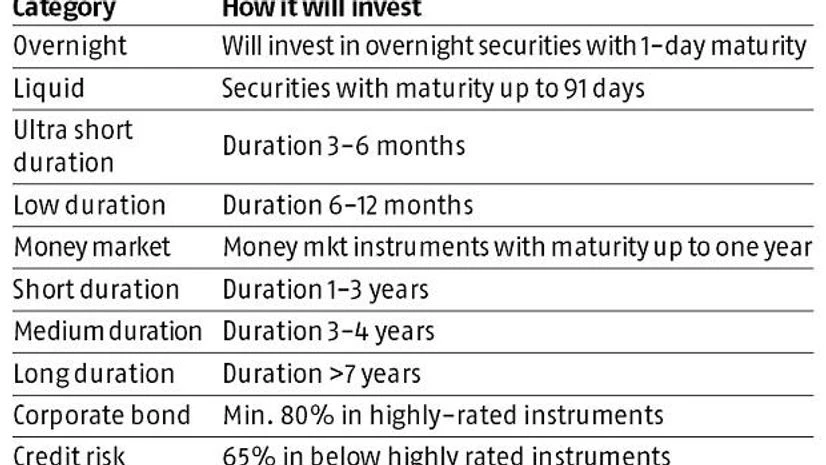

In the recent re-categorisation of schemes that fund houses have undertaken in response to the Securities and Exchange Board of India’s (Sebi’s) October circular, many debt and hybrid funds have been shuffled around. Investors need to understand the change that has happened in the funds they hold and only then decide whether to stay put or exit and move to another fund. Among debt funds, a large number of categories, 16, have been created. In the very short-duration segment, only liquid funds existed earlier, which invested in papers with a maturity of up to 91 days. Now, two new categories

Wednesday, March 05, 2025 | 04:18 AM ISTहिंदी में पढें

Funds will stick to duration norms, but may take credit risk

After the implementation of new categorisation norms, this is a risk debt fund investors need to watch out for

)

Premium

graph

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in