The Rs 55,000-crore automobile aftermarket industry has been going through a transition. On the one hand, key players such as Mahindra & Mahindra and Carnation have moved out of the business; on the other, original equipment manufacturers (OEMs) such as Groupe PSA and Toyota are entering the business.

In between, the 12-year-old aftermarket service provider TVS Automobile Solutions Ltd (TVS ASL), in which the TVS group holds a 59.8 per cent stake, is trying to consolidate its position by building a strong technology solution and supply chain. The $175-million (around Rs 1,200 crore) company is targeting around $500 million (Rs 3,600 crore) in three years and plans to open one new franchisee every day in 2021-22.

Five years ago, the company had gone in for a major rejig of its brand — myTVS — and last November it acquired Mahindra First Choice's service business. Mahindra First Choice was the multi-brand car and two-wheeler service workshops and part of Mumbai-headquartered Mahindra Group. In a share swap deal and as part of the transaction, Mahindra & Mahindra secured a 2.76 per cent stake in TVS ASL.

With this integration, the MyTVS brand is the only organised pan-Indian aftermarket multi-brand network of this scale and size with 650 franchisees across 270 towns, said G Srinivasa Raghavan, managing director, TVS ASL.

By the end of 2021-22, it intends to have around 1,000 outlets, of which 20 per cent would be company-owned. “With that, we should be the largest in this part of the world,” said Raghavan, adding that TVS ASL currently services close to a million vehicles in its network and it will double it with the proposed expansion. The company has also created a supply chain base by partnering with around 85 suppliers across the country and has set up 80 “fulfilment centres” to ensure that spares are available between two and 24 hours.

The physical formats are backed by new-age technologies. For example, the company partnered with Google to create a “Super Platform”, which will be rolled out in India by next month and will be scaled up to other parts of the world, including developed markets such as Europe and neighbouring markets of Sri Lanka and Bangladesh.

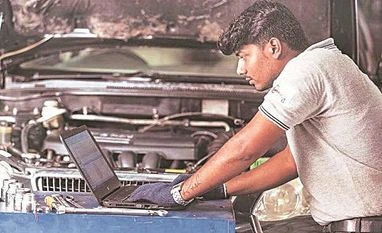

The company has also developed a multi-brand diagnostic platform with both telematics and scanner integrated for the first time on the cloud. Earlier, the diagnostics were done either in the car or at the centre. Now it is on the cloud for 44 car models. According to Raghavan, for nearly 60 per cent of the services for the vehicle, a customer need not come to the service centre at all.

The entire diagnostics is also integrated with the marketplace. To this end, TVS ASL has formed a digital ecosystem with tyre manufacturers, battery makers, paint companies and parts producers. “From repair, we moved to break down and now we are moving to full vehicle management,” said Raghavan, whose company created a digital catalogue that has more than 10 million parts and provides the choice to customers and franchisees.

The company also created a digital platform and ecosystem for over 2,500 garages and plans to expand its network to over 10,000 garages in the next 18-24 months.

The combination of scale and technology has helped myTVS become price-competitive by 15-20 per cent, which not only attracts the retail customers, but also the OEMs. The company has already signed with two OEMs, Mitsubishi and Nissan, for a service partnership.

In India, nearly 60 per cent of vehicles are serviced outside the OEM service centres after the warranty period. Around 500,000 garages cater to the highly fragmented industry. So TVS ASL is banking on its technology and strong supply-chain for profitability. Raghavan benchmarks its interface/solutions with Swiggy, Ola and other applications.

Raghavan joined TVS ASL in 2013 after a stint with Tata Consultancy Service (TCS). He had set up a team at TVS ASL to develop new-age solutions principally driven by acquisitions. In the last three years, the company has invested Rs 500 crore to acquire nearly 10 companies (the table lists some of them) The company also opened doors for private equity, including Kitara Capital (15 per cent in 2011) and Mitsubishi Corporation (25 per cent in 2019).

According to India Ratings & Research, TVS ASL is well diversified on the supply side with its single-largest component supplier contributing less than 20 per cent of the total purchases.

It added that with the wholesale APD (auto parts business which the company calls “PartSmart”) business reaching a sizeable revenue level, the company is technologically integrating all its business, other than wholesale parts distribution. This, the agency believes, is likely to drive the synergies between the different touchpoints in its retail distribution network and, therefore, can potentially accelerate the shift from the unorganised to organised aftermarket segment.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)