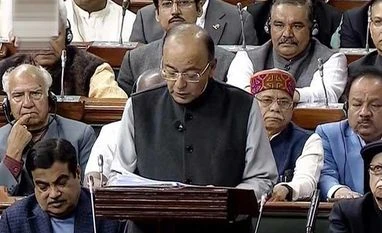

Considering India as Agriculture and developing country, Finance Minister allocated resources to Rural Sector and health Sector.

As fiscal deficit is estimated at 3.5% as against 3.9% of previous year and look forward for 3.3 % deficit to GDP for FY 19.

Also Read

- No Major incentive to small taxpayers and tax cut and no increase too which will hit directly to pockets.

- Few surprises by finance minister to balance the benefits provides are 10% tax on Long Term Equity Capital Gain Tax without removing Securities transaction Tax. This will surely a thinking stone in mind of Investors and may change the investment perspective to look at other options of investment wherein overall after-tax returns are more!!

- No Hopes and Goody News for Middle Class - No Change in Personal Income Tax Slab but benefit to middle class tax payer by providing Rs. 40,000/- standard Tax deduction for transport and medical reimbursement for salaried employees.

- Incentives to Senior Citizen - Budget provide a thumb up incentive to Senior Citizen

- Senior citizens to get Rs 50,000 per annum exemption for medical insurance under Sec 80D - Exemptions in income of Rs 30,000 from Banks FD and post offices from existing limit of 10,000/-

- Long-term capital gains taxed from listed equities exceeding one lakh at 10 percent without benefit of Indexation.

- FM reduced Tax Rate to 25% for companies with turnover up to Rs. 250 Crore, will surely help small cap companies and to reduce tax burden and focus on growth.

- Custom Duty on certain products as raised as to gear up Make in India Campaign thus mobile phones and Television Set Cost will go Up!

Here is Monjin take:

The Government’s commitment to maintain fiscal discipline is welcome with the fiscal deficit target at 3.3% for FY19. This despite additional allocation to the rural sector and for health.

From a startup standpoint the reduction of corporate tax to 25%, for companies with a turnover upto Rs. 250 Crore, is a positive move. This will help profitable startups grow.

However, we are disappointed that the deeming provisions under section 56 (2) (viib) as relates to share premium being treated as income have not been removed, particularly for technology startups. This results in unnecessary hassle and cash outflow for internet-based startups where revenues take time to catch up to perceived longer term valuations of the unique concept/ idea of the company.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)