Despite market sentiments remaining subdued over the past 18 months, ABB India Limited (formerly ABB Limited) has shown signs of revival during the first quarter ended March 2013, with a growth of 10 per cent in revenues despite delay in decision-making by the customers. It has also recorded growth in orders for its short-cycle business, which are fast moving orders for the company. ABB follows January to December financial year.

“The sentiment in the market is such that people are hesitating to take decisions. The discussions are going on, the projects are not as such shelved. It is the delay in the decision making that we are experiencing right now,” Bazmi Husain, managing director of ABB Ltd, had said in an investor call after announcing the company’s first quarter results in May. The company did not reply to Business Standard’s questionnaire.

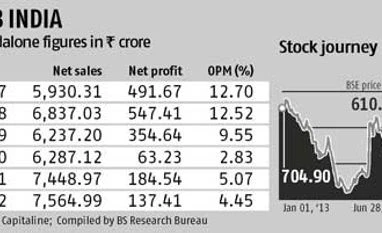

For the quarter ended March 2013, ABB reported 10 per cent growth in revenues at Rs 1,953 crore over the same quarter last year. Its net profit, however, fell 11 per cent to Rs 43 crore. This was because calendar 2012 proved to be a difficult year for ABB India. Decline in large orders triggered a drop of 15 per cent in order inflows last year. Additional costs required for executing orders due to inordinate delays in projects also hit profitability. The company’s earnings before interest, taxes, depreciation, and amortisation (Ebitda) margin adjusted for forex loss was just four per cent.

Investors were also not very happy with the fact that ABB’s expenditure on royalty, trademark, technical, consultancy and IT on parent/fellow subsidiaries grew 24 per cent to Rs 370 crore in calendar year 2012. This contributed to weak margins. The phenomenon has intensified over the past few years, says a JPMorgan report. The company's stock is down 13 per cent since January this year, compared to a 16 per cent drop in the BSE Capital Goods Index in the same period last year.

According to analysts, growth in the first quarter revenues is significant considering the fact that in the fourth quarter ended December 2012, the firm had reported a 5.3 per cent drop at Rs 2,053 crore, compared to Rs 2,170 crore in the corresponding period of the previous year. For the full year ended December 2012, the revenues were marginally down by 1.3 per cent at Rs 7,470 crore, against Rs 7,370 crore in 2011.

ABB’s order book declined eight per cent to Rs 1,531 crore during the quarter ended March 31, compared to an order intake of Rs 1,663 crore for the same period last year.

“The sentiment in the market is such that people are hesitating to take decisions. The discussions are going on, the projects are not as such shelved. It is the delay in the decision making that we are experiencing right now,” Bazmi Husain, managing director of ABB Ltd, had said in an investor call after announcing the company’s first quarter results in May. The company did not reply to Business Standard’s questionnaire.

For the quarter ended March 2013, ABB reported 10 per cent growth in revenues at Rs 1,953 crore over the same quarter last year. Its net profit, however, fell 11 per cent to Rs 43 crore. This was because calendar 2012 proved to be a difficult year for ABB India. Decline in large orders triggered a drop of 15 per cent in order inflows last year. Additional costs required for executing orders due to inordinate delays in projects also hit profitability. The company’s earnings before interest, taxes, depreciation, and amortisation (Ebitda) margin adjusted for forex loss was just four per cent.

Investors were also not very happy with the fact that ABB’s expenditure on royalty, trademark, technical, consultancy and IT on parent/fellow subsidiaries grew 24 per cent to Rs 370 crore in calendar year 2012. This contributed to weak margins. The phenomenon has intensified over the past few years, says a JPMorgan report. The company's stock is down 13 per cent since January this year, compared to a 16 per cent drop in the BSE Capital Goods Index in the same period last year.

According to analysts, growth in the first quarter revenues is significant considering the fact that in the fourth quarter ended December 2012, the firm had reported a 5.3 per cent drop at Rs 2,053 crore, compared to Rs 2,170 crore in the corresponding period of the previous year. For the full year ended December 2012, the revenues were marginally down by 1.3 per cent at Rs 7,470 crore, against Rs 7,370 crore in 2011.

ABB’s order book declined eight per cent to Rs 1,531 crore during the quarter ended March 31, compared to an order intake of Rs 1,663 crore for the same period last year.

For the past several quarters, ABB has been talking about the cost focus, while increasing its operational efficiency, whether it is on the shop floor, or on the project side or looking at optimising supply chain. “I think these are things that have continued to help us in this uncertain economic environment, as I would call it,” said Husain.

He added in the investors call: “When it comes to the large projects though, I would not even like to give any estimate of how long the uncertainty will remain. However, I think the long term, the demand side of the equation in India continues to remain strong and robust. It will turn around, but the timing of it is uncertain at this point.”

ABB is now looking at fresh growth opportunities in areas such as energy efficiency and solar. It is also upgrading its factories, setting up new plants for gas-insulated switchgear (GIS) and dry-type distribution transformers. “We will be the first one in the country, and we will roll out first transformer soon,” said Husain.

The company has shown good growth in service area and also in exports, compared to last year. “Exports continued to grow at a healthy 20 per cent in 2012. ABB has significantly increased manufacturing capacity in India in the last few years and is now amongst the top three capital goods exporters. We expect exports to increase, largely driven by sales of wind turbine generators from the company's Vadodara facility,” said Motilal Oswal Securities Ltd (MOSL) in its latest report on capital goods.

According to MOSL, ABB continues to face margin pressure across business segments, particularly in project businesses, impacted by sluggish revenue growth and cost overruns. Profitability in power systems remains low even after complete exit from the rural electrification business due to low-margin legacy orders and cost overruns in several projects.

Profitability in process automation also remains subdued, contrary to earlier expectations of sustained improvement, according to the MOSL report.

Big beneficiary

“We believe ABB will be one of the biggest beneficiaries of the ongoing power sector reforms, given its wide presence in high technological products. ABB is amongst the key players in Smart Grid, which could be a potential growth area, given increased awareness to improve grid efficiency post the black out of the northern grid last year,” Motilal Oswal added.

ABB hopes orders in mid-size projects will improve over the next two-to-three quarters. The management remains cautious of any pick-up in large orders in the near-term, although state electricity boards (SEBs) ordering is likely to improve, led by financial restructuring.

)