In the second major setback to the lenders bid to revive the grounded Jet Airways by selling it out, billionaire businessman Anil Agarwal, a day after announcing interest in the airline, Monday said he is no longer interested to pursue the deal.

With this, only two financial investors are left in the fray. Already deep-pocketed players like Etihad, which is already is an equity partner in the airline and also the Hindujas have backed out of the sale process.

On Sunday, Volcan Investment, Agarwal's investment company said it had submitted the expression of interest on Saturday-the last day of the extended bidding process--in an exploratory manner to buy stake in the airline that stopped flying mid-April and since June under bankruptcy proceeding.

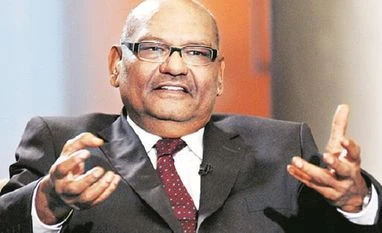

"The expression of interest submitted for Jet Airways by Volcan was exploratory in nature. On further evaluation and considering other priorities, we intend to not pursue this further," the mining baron Agarwal who owns the LSE-listed Vedanta Resources, said in a statement.

The lenders had extended the last date for submission of EoIs till August 10 from August 3 after failing to get any response by the first deadline. They had faced a similar situation in April when though four parties, including Etihad and TPG Partners, submitted EoIs, none moved ahead.

With Volcan pulling out, only two entities are left in the fray to buy stake in the airline.

Etihad which holds 24 percent stake in Jet Airways, also stayed away from participating in the second round.

In a statement, Etihad Monday said it has declined to submit an EoI to reinvest Jet Airways because of the unresolved issues concerning the airline's liabilities.

In April, Etihad had presented a conditional expression of interest to reinvest in Jet as a minority stakeholder, with a partner, but it did not materialise.

"We remained engaged in the process, but despite the endeavours of everyone involved there remained very significant issues relating to Jet's previous liabilities.

Regrettably, in these circumstances, it was neither feasible for nor responsible on our part to reinvest in Jet at this time," the UAE flag carrier said.

The lenders, who had been owning the airline since March 25 with 51 percent stake, had on June 17 sent the airline, which stopped flying on April 17, to the NCLT as they could not find a buyer.

Early July, the RP had said he had received claims worth over Rs 25,500 crore as of July 4, including over Rs 200 crore from founder Naresh Goyal, submitted by the holding company of the airline JetAir, but was rejected.

State Bank has made a claim of Rs 1,644 crore, including cash credit inclusive of interest, term loans and bank guarantees. Yes Bank has claimed Rs 1,084 crore, followed by PNB's Rs 963 crore and IDBI Bank's Rs 594 crore.

Operational creditors excluding workmen and employees have made a claim of Rs 12,372 crore, with the entire amount being under verification, while the workmen and employees have made a claim of Rs 443 crore which is also under verification.

Apart from this, authorized representatives of workmen and employees have made 11,965 claims of Rs 735 crore, the RP said, adding other creditors, including other financial creditors and operational creditors, have made 121 claims amounting to Rs 1,105 crore.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)