Same-store sales growth refers to sales growth at stores opened at least a year ago.

Jubilant isn’t the only company faced with these challenges. Westlife Development, whose subsidiary Hardcastle Restaurants is the franchisee for McDonald’s in west and south India, reported same-store sales growth of just 0.5 per cent in the June quarter. This was lower than 6.2 per cent reported for the 2012-13. For 2011-12 and 2010-11, the company’s same-store sales growth stood at 22 per cent and 19 per cent, respectively, said Amit Jatia, the company’s vice-chairman.

Yum!, owner of brands such as Pizza Hut, KFC and Subway, didn’t touch the double-digit-mark in the June quarter, said industry sources.

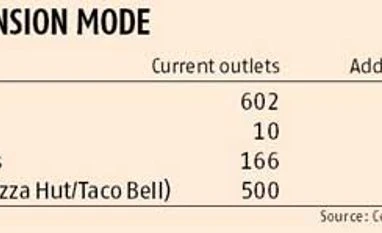

Despite this, companies continue to be bullish about their growth plans in India. While announcing Jubilant’s first-quarter numbers last month, chief executive Ajay Kaul said the Noida-headquartered firm would set up at least 125 Domino’s stores and 18 Dunkin’ Donuts outlets this financial year.

But are these store additions sustainable? Kaul insists as Jubilant enters new cities, it would see growth prospects. “Out of a total of 128 cities we are present in, 74 have one Domino’s store; 15 have two stores. The top ten cities, however, have about 370 stores. If you look beyond the top ten, there is potential for growth,” he says.

Yum!, say industry sources, is targeting tier-II and III cities. Recently, the company opened its 500th store in Bangalore. Yum! Brands—Pizza Hut, KFC and Taco Bell—are present in 55 cities. The company plans to spread the next 500 stores equally across metros, other major cities and tier-II and -III cities.

Westlife’s Jatia says the company’s expansion plan is in keeping with the long-term prospects of the business. “The short term remains challenging, more so because of the economic environment. But we remain confident of the long-term prospects of the business,” he says. In the next two years, the company would spend about Rs 300 crore to expand its footprint in the western and southern regions.

This year, Jubilant would spend Rs 250 crore in setting up four new factories or commissaries (in cities such as Nagpur, Hyderabad and Guwahati; its Noida plant would be relocated), besides launching its proposed Domino’s and Dunkin’ Donuts outlets.

What gives these companies the confidence to expand is the under-penetration of the food services market in India. A recent report by brokerage CLSA said the proportion of sales generated through such chains was less than 10 per cent in India, lower than markets such as Thailand, Indonesia and the Philippines (about 25 per cent).

)