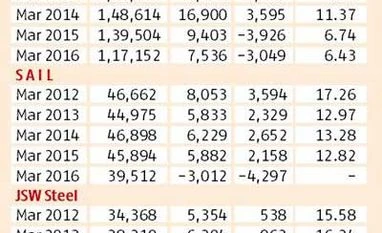

In terms of profits, Tata Steel India has always been ahead of JSW Steel and Steel Authority of India Ltd (SAIL). The contrast got starker in financial year 2016, when the steel major recorded a net profit of Rs 4,901 crore as against a standalone loss of Rs 3,498 crore by JSW Steel and Rs 4,137 crore by SAIL.

“Tata Seel India is one of the low-cost producers in the world. We have been for a while and will continue to be,” said

T V Narendran, managing director, Tata Steel India and South East Asia. Along with SAIL, the company has an edge over competitors by virtue of raw material linkages.

Tata Steel’s coal security comes from west Bokaro division and the Jharia coalfields with estimated reserves of 287 million tonnes (mt). About 65 per cent of coal requirements are, however, met through imports; iron ore needs are met by the Noamundi, Joda, Khondbond and Katamati mines. According to Narendran, raw material linkages help but the advantage is limited, given the raw material prices are low and the taxes on captive raw materials in India are high. “What drives our competitiveness is our relentless pursuit of cost efficiencies across the value chain. Today, only a few other steel companies who have a fully integrated value chain and operate in countries like Russia and Brazil and have benefitted from a weak currency over the last year or so, have a better cost position than us,” he added.

Automotive and special products achieved highest ever sales of 1.43 mt and contributed to 15 per cent of total sales; branded products and retail sales surged to 3.35 mt and contributed 35 per cent. Tata Tiscon registered highest ever sales of 2.51 mt in FY16, a growth of 13 per cent while retail customers increased to 3,000,000 households across India. The company is not resting on its achievements. It is trying to consolidate its leadership position in the domestic automotive segment. The stabilisation and ramp-up process of the three-million-tonne Kalinganagar plant is currently underway. The facility will produce flat steel for high-end applications, enabling the company to expand its product portfolio in the shipbuilding, defence equipment, energy & power, oil & gas, infrastructure and aviation sectors.

“In the last five years, Tata Steel has invested over Rs 40,000 crore, to increase capacity from seven mt to 13 mt in India,” Narendran said. Simultaneously, the company is also working on expanding capacity at its Jamshedpur plants.

The company has got environmental clearance to increase hot metal capacity in Jamshedpur to 12.5 mt and steelmaking capacity to 11 mt.

But, the Indian operations were never a cause for worry. Its overseas operations that had not quite gone according to plans. "We have had a significant movement in the South East Asian operations due to the various actions taken there to focus on cost efficiencies and market facing initiatives. We have also pruned the portfolio further so that we are more focused on the businesses that have a long-term future," Narendran said. Tata Steel has a two mt footprint in south east Asia, where steel consumption is growing at six per cent.

"Bangladesh is another fast growing market that we will try to service out of India," he said.

What about Europe? "There are a number of actions underway to optimise our footprint and build long-term competitiveness," is all that Narendran is willing to say at the moment.

Tata Steel had announced restructuring of its European portfolio in March which included divestment of Tata Steel UK, in whole or in parts, after struggling to make it work for nine years. In the last five years, it had suffered asset impairment of two billion pounds.

)