Even as these companies are looking to diversify into non-engine parts, scouting for acquisitions to stay relevant in the newly emerging eco-system, they are confident that internal combustion engine (ICE) is here to stay at least for a decade and half, if not more. To be sure, meeting the BS-VI emission norms, which kick off on April 1, 2020, is on top of their priority list.

Take the case of Shriram Pistons & Rings (SPR), one of the largest manufacturers of engine aggregates and parts, that counts almost every other automaker as its client. The company draws two-thirds of its revenue from engine related parts in the personal mobility space. As part of a risk mitigation strategy, SPR plans to strengthen presence in off-highway applications, tractors and such like, which are expected to be insulated from electric mobility. It is also stepping up presence in the aftermarket segments in India and abroad, says Ashok Taneja, managing director and chief executive at the firm. The company is also working towards diversifying into non-ICE parts and tapping into new areas, including braking and light-weighting by way of acquisition.

Others have a similar approach. “I think there will be lot of space for ICE for many years to come,” says Tarang Jain, managing director at Aurangabad-based Varroc Group, which makes lighting systems among other auto parts. Jain points out that transition has been slow even in most of the developed markets. However, he doesn’t want to be caught off-guard. His company, which draws a third of revenue from engine and emission parts, is working on the electronic motor side of the powertrain. Varroc is also looking for a collaboration with start-ups, and at acquisitions to tap into the EV space, but is not in a rush. “My immediate priority is BS-VI, he says.

The government's announcement on electric mobility has served as a huge distraction for an industry that has left no stone unturned to switch to world’s strictest emission norms, says Vinnie Mehta, director general at ACMA. Automobile and auto parts makers, and oil refiners are estimated to fork out anything between Rs 700 billion and Rs 900 billion as a run up to leapfrogging from BS-IV to BS-VI emission norms.

SPR’s Taneja asserts that while his firm is not holding back any investment, it is a lot more cautious and trying to not set up greenfield plants. It is instead optimising production at existing plants. “While we look for other opportunities, we have to invest a lot in BS-VI and that’s not the end of story as the advance fuel emission norms will require further investments. “Clearly, we have to do some tight-rope walking," he says.

With companies being cautious on fresh investments in ICE-related parts, the demand is going to outpace supply, says F R Singhvi, joint managing director at Bengaluru-based engine parts maker Sansera Engineering. With so much talk around EVs, no new company is going to invest in a new engine parts unit. This will result in the number of suppliers coming down and capacities will shrink. This will be a positive for existing suppliers like Sansera, he says. “We are in a good situation for the next 15 years,” asserts Singhvi, adding that Sansera will consider investment in EVs only after it reaches critical mass. It doesn’t take long to forge collaborations or buy out a start-up, he feels.

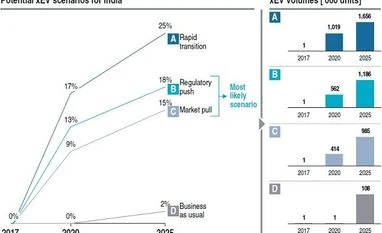

Even as mass adoption of EVs will be slow in India, traditional powertrain component suppliers “must act now, or else risk losing the opportunity to Chinese suppliers,” says Wilfried Aulbur, senior partner, Roland Berger. Indian companies need to acquire technology inorganically, reach global markets swiftly and demonstrate capabilities to global and local automakers, he says.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)