Profitability gains offset a 22 per cent y-o-y fall in net sales to Rs 51,917 crore. The fall in topline, though expected, can be largely attributed to soft crude oil prices which more than offset the 13.7 per cent y-o-y rise in crude throughput to 6.1 million metric tonnes in the quarter.

What looks more sustainable is interest cost. Analysts expect the benefits of lower finance costs as well as raw material costs to continue till the December 2015 quarter. Crude oil prices had started falling around November-December 2014, leading to lower raw material costs and working capital needs for BPCL and its peers. Full de-regulation of diesel prices, too, put the downward pressure on these companies’ finance costs.

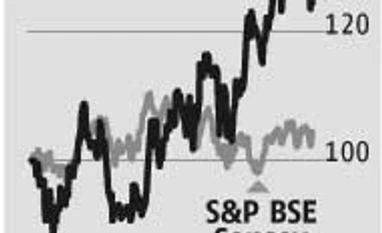

While analysts are set to raise their full-year earnings estimates for BPCL, the stock seems fairly valued for now. At 2.5 times FY16 estimated book value, BPCL is priced at a premium to peers such as IOC and HPCL which are trading at 1.2 times and 1.8 times, respectively. But that has been the case ever since BPCL saw success in its exploratory and production business, which has huge potential especially from the Mozambique and Brazil fields.

Trimming some stake by the government in BPCL and any delay in exploration & production activities are the key downside risks and could reduce the premium valuations going forward. HPCL remains most levered to crude oil prices and, hence, stands to gain the most from subdued crude oil prices. In case of IOC, positive newsflow around its Paradip refinery could be a key catalyst.

)