Strong buying was witnessed in the counter by investors on optimism that the buyback will be at a rate much higher than the prevailing market price, experts said, adding, the buyback amount will be substantial, which would boost the company’s earnings per share (EPS) and return on equity. Shares of Infosys gained 4.54 per cent, the most since November 25, 2016, to close at Rs 1,021.2, the highest level since April 3.

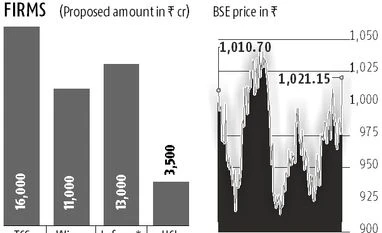

Infosys’ board will meet on Saturday to consider a Rs 13,000-crore share buyback proposal. The buyback has been a long-standing demand by some of the founders and high-profile former executives, who have been pushing the IT major to return surplus capital to its shareholders.

“This has put to rest speculation on the timeline of the buyback. While the quantum and price of buyback is yet to be finalised, the management’s earlier figure of Rs 13,000 crore (including dividend) hints at a much bigger buyback in the offing compared to those by peers TCS, HCL Tech and Wipro,” a note by Edelweiss said.

Infosys shares are trading at 15 times its FY18 estimated earnings and 13.5 times its FY19 estimated earnings, according to Edelweiss.

“For Infosys, the buyback will lead to higher return on equity and payout ratio. We do not perceive this move to be an outcome of lower growth; instead, it well means limited possibilities of large acquisitions, and consistent generation of cash,” said Edelweiss, which has a ‘buy’ rating on the stock with a target price of Rs 1,155.

IDBI Capital said a buyback of Rs 13,000 crore would extinguish up to five per cent of the company’s share capital. This could improve Infosys’ return on equity to 25.3 per cent in FY19, from 22.6 per cent in FY17.

At the end of the June quarter, Infosys was sitting on a cash pile of $6.1 billion. Analysts said the buyback would improve the company’s valuations.

“The announcement will act as a definite valuation support over the near term.... Our price target of Rs 1,200 discounts forward EPS by 17 times. Concerns over distraction from ongoing dialogues between the founders and board on governance issues pose risk to an upside,” said a note by Motilal Oswal.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)