Reliance Industries’ (RIL’s) announcement on its retail business Reliance Retail, which includes its online grocery segment JioMart, has affected investor sentiment towards Avenue Supermarts.

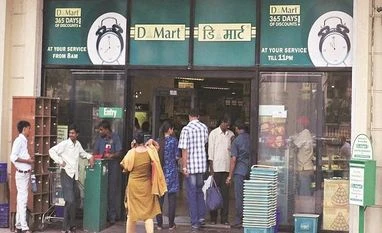

The stock of Avenue Supermarts, which operates the popular chain of DMart hypermarkets, has shed 6 per cent since last Wednesday (July 15), adding to the 7.6 per cent decline between July 11 and July 14 that it had seen after weak results. Since July 11, the Sensex has risen 2.3 per cent.

During the annual general meeting last Wednesday, RIL Chairman and Managing Director Mukesh Ambani announced that the company had received interest from strategic and financial investors for Reliance Retail and it would get some onboard over the next few quarters.

Given RIL’s track-record and its achievement with Jio Platforms, its commitment and plans for the retail business, along with JioMart’s tie-up with WhatsApp and local kirana stores, mean a potential increase in competition for players like DMart.

While the impact of increased competition would be felt across the retail industry, it becomes more crucial for Avenue Supermarts’ investors, given the stock’s extremely rich valuation of over 80 times FY21 estimated earnings. For now, many analysts believe that the impact may not be significant for DMart, given its strong moat.

Varun Singh, analyst at IDBI Capital, says: “Avenue Supermarts has strong cost efficiency in place, which gives it strong power to offer value (products below the maximum retail price).

This will continue to bode well for the firm.” Owned stores, no last-mile cost, strong warehousing efficiency, and direct procurement are some key levers in favour of Avenue Supermarts. Thus, Singh believes it will be a tough task even for players like Reliance Retail to beat Avenue Supermarts.

Vishal Gutka, analyst at PhillipCapital, shares a similar view. “The large, financially strong listed grocery retailer has a unique model, which gives it an edge over other organised players.”

Avenue Supermarts is estimated to post Rs 37,000 crore in revenues, besides an operating profit of over Rs 3,000 crore in FY22. However, there may be some correction in Avenue Supermarts’ valuation in the near term, mainly because of the impact of sentiment and expensive stock valuation despite slower growth, says Gutka.

What is driving the strong footfall for Avenue Supermarts is its product mix, which is tilted towards grocery (over per cent of revenue). Reliance Retail is currently more focused on consumer electronics, and has big plans for its grocery business.

The combined strength of Reliance Retail and JioMart — strong financials, a large client base, sourcing efficiency and technology — cannot be ignored. Reliance Retail is India’s largest and most profitable retailer with revenue of Rs 1.6 trillion and operating profit of Rs 9,654 crore in FY20. Nomura estimates its operating profit to almost double to Rs 18,400 crore in three years.

These attributes will come handy in executing RIL’s larger retail strategy, which some analysts believe is a potential threat to all peers.

Sunil Jain, head of research at Nirmal Bang, says: “How JioMart executes its strategy, mainly in terms of profitability, is the key... However, we believe JioMart, too, has a strong moat in terms of Jio connectivity, strong financial support, etc, which will give a tough competition to players like Avenue Supermarts.”

Within a short span of launch, JioMart is witnessing cumulatively 250,000 daily orders across 200 cities. Reliance Retail also sources over 80 per cent of fresh fruits and vegetables directly from farmers.

Even as DMart is a well-established retailer with strong financials and a robust business model, competitive intensity is likely to increase. And, this may keep a check on its stock performance and valuation.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)