S Sandilya, president, Society of Indian Automobile Manufacturers (Siam), said, "The auto industry is a significant growth driver of the economy. We, as a country, have been focused on manufacturing and not trade. Given this, any kind of concessions given to the EU as a group of countries would be retrograde." According to government sources, EU is negotiating to import 250,000-300,000 cars over a five year period starting 2017 at concessional duty of 10 per cent. Additionally, the trade bloc has insisted on 50 per cent reduction on tariff lines of 60 per cent on imported cars as prevalent during the start of the talks in 2007.

What has raised concern among domestic automakers is the EU is asking for tariff barriers to be lowered on "non-new goods" as well, a proposal, which if accepted, would impact both new and pre-owned vehicle sales in India. An executive said, "If the import duty is lowered on pre-owned cars, given the restricted purchasing power of Indian consumers, the country would become a dumping ground for used cars from the EU market." The import duty on pre-owned cars in India currently stands at 150 per cent, while the duty of new vehicles priced above $ 40,000 was increased to 100 per cent in the Budget for FY14.

Industry experts are apprehensive that the reduction of tariff on completely built up units (CBUs) under India-EU FTA will be a complete reversal of the policy of high tariffs to force investment, local manufacturing, local value addition and local employment.

Automotive trade already favours EU. In 2010-11, while EU exported automotive products valued at $3.4 billion to India including $400 million worth of CBUs, India exported cars worth $1.7 billion to the EU. A majority of these were hatchbacks. It did not export any CKDs. Overall, India exported $ 3.5 billion worth of automotive products to the European Union.

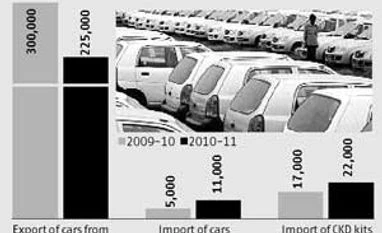

India's gains in terms of market access in auto exports to EU through reduced tariffs are also limited. Data shared by SIAM reveal exports of small cars to EU have declined from almost 300,000 in 2009-10 to around 225,000 in 2010-11 after the discontinuation of the scrappage scheme. Imports of CBUs from EU, in the same period, has increased from 5,000 large cars in 2009-10 to 11,000 in 2010-11. Imports of CKDs (completely knocked down kits) increased from 17,000 numbers in 2009-10 to 22,000 in 2010-11.

Automotive products export of EU to India grew by 51 per cent last year, including 109 per cent growth in car exports. This is against 11per cent growth in import of automotive products from India to EU and a decline of 15 in cars. After a reduction in tariffs is made under the proposed FTA, the trade gap would further expand against India, said SIAM in a white paper released last week.

)