Indian drug companies are readying a pipeline of speciality generics and biosimilars to make the most of the next growth wave in the US market.

Speciality drugs have contributed almost two-thirds to the overall medicine spending growth in the US over the past five years.

A recent Edelweiss report, Pharmaceuticals--Time to Evolve, said biosimilars and inhalers would be 50 per cent of the opportunity, which most Indian companies would not be able to tap.

“If we exclude these opportunities, the generics opportunity shrinks to $55 billion for 2016-20, which is significantly lower than the $75 billion opportunity on offer during 2011-15,” the report said. “We expect generics growth to reduce to 1 per cent by 2020 compared to 15 cent CAGR (compound annual growth rate) over 2010-15,” it added.

Sun Pharmaceuticals has a speciality generics pipeline ready for the US. From a revenue of $2.2 billion in 2014-15, Sun Pharmaceuticals' US business is expected to clock 13 per cent CAGR to touch $4.3 billion by 2020. Nearly 18 per cent of Sun Pharmaceuticals' revenues will then come from the speciality business like dermatology and ophthalmology, around 6 per cent from the branded drug business, and about 45 per cent from the complex generics business that involves long-acting injectables and controlled substances.

Sun Pharmaceuticals had entered the speciality business with the acquisition of a skincare company Dusa in 2002 for $230 million. "Sun Pharmaceuticals is focussing on building its speciality business in dermatology and ophthalmology. We also have products from the Ranbaxy portfolio,” a company spokesperson said,

“In dermatology, we have signed an in-licensing deal with Merck for Tildra, a biologic for several indications currently being developed for psoriasis,” the spokesman added. Sun Pharmaceuticals also recently acquired InSite Vision to improve its ophthalmology pipeline.

According to various estimates, the US dermatology market is worth $10 billion and it clocked a CAGR of 11 per cent in revenue over 2013-15. The US ophthalmology market is worth $7 billion and it clocked 14 per cent CAGR over 2013-15.

The speciality pharmaceuticals market in the US grew 26.5 per cent to $124.1 billion in 2014. Spending on speciality drugs has increased by $54 billion in the past five years, contributing 73 per cent to overall medicine spending growth during that period.

Lupin, too, has started making a move towards the complex generics business by acquiring Gavis Pharma. With the acquisition of Gavis Pharma, which concentrates on dermatology and controlled substances, Lupin has a portfolio of 101 in-market products, 164 cumulative filings pending approval and a deep pipeline of products under development for the US.

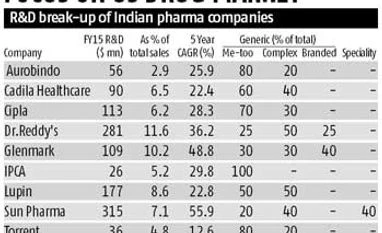

“The company spends 50 per cent of its R&D budget on the complex generics business,” said the Edelweiss report. “We have always focussed on developing and filing for difficult-to replicate, extended release formulations in niche therapy segments,” said Ramesh Swaminathan, chief financial officer, Lupin.

“Lupin has emerged as the sixth largest generics player in the US, inspite of being a late entrant (it entered the US generics space in 2005," he added. “We started filing for oral contraceptives in 2007-8, one of the first global generic players to do so after Teva and Sandoz. Similarly, we started addressing the ophthalmology segment in the US in 2009-10. These are all complex generics,” Swaminathan said.

Lupin also acquired Nanomi in the Netherlands to strengthen its capabilities in complex injectables. It has set up research centres in Florida and Maryland in order to shorten the time-to-market. “We today have a high-quality generic pipeline of over 225 filings in the US, addressing a market size of close to $65 billion,” Swaminathan said.

He added, “The average R&D spending for the industry is around five to seven per centper cent, while our R&D spending for 2015-16 is inching towards 10 per cent.”

has invested over half a billion dollars in research over the last 3-4 years alone," Swaminathan said.

Sun Pharmaceuticals’ 2014-15 R&D spending is around $315 million, or about 7.1 per cent of its total sales. For the first six months of the current financial year, its R&D spending was 7.6 per cent of its net sales, a company spokesperson said. "Based on our investments in the speciality product pipeline, these may inch up a bit from these levels over the next few years," he added.

Biologics represent a sizeable 28 per cent of the US market and 40 per cent of the off-patent revenue will become generic over the next five years. However, analysts feel that the addressable space for Indian companies will be fairly limited as higher development cost of $100 million per molecule is not the only limiting factor.

Ahmedabad-based Cadila Healthcare's US pipeline has a number of niche filings. It has around 165 pending ANDAs on platforms like mesalamine based filings (Asacol HD and Lialda), transdermals, nasals, controlled substances, among others.

The company is also working on biopharmaceutical areas like biosimilars and vaccines. Analysts said that it is also investing in a biopharmaceuticals pipeline, biosimilars and vaccines, and has two advanced biosimilar assets for regulated markets, namely, Adalimumab (it had launched the first biosimilar of Adalimumab under the brand name Exemptia in December 2014 in India) and Pegfilgrastim.

Bangalore-based Biocon has an exclusive collaboration with Mylan for the development and commercialisation of Insulin Analogs and Biosimilars. For that matter, Biocon has four molecules including Adalimumab (auto-immune disorders), Pegfilgrastim (used for treatment of infections in cancer patients) targeting a market size of over 30 billion.

The company is in the process of setting up Asia's largest integrated insulin manufacturing facility in Malaysia, with a capital expenditure of over $200 million and is aiming to file for emerging markets sourcing from this facility some time in FY17.

On the whole, analysts feel that with the generics space getting crowded in the US, growth rate would become a challenge by 2020. However, while the only way forward for Indian companies is to move up the speciality value curve, this business, unlike generics has high entry barriers in terms of development, regulations and convincing the payers and doctors.

)