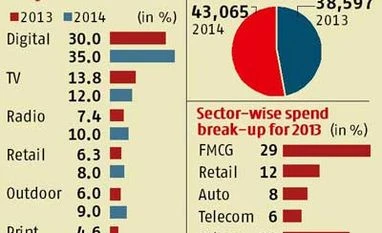

However, if advertising by political parties was excluded, overall ad growth for the sector would stand at nine per cent, C V L Srinivas, chief executive of GroupM South Asia, said at a media briefing on Monday. The marginal drop in overall ad growth would be on account of TV advertising, whose growth would stand at 12 per cent, Srinivas said. Last year, growth in TV advertising was 13.8 per cent. In value terms, TV advertising will remain the largest contributor to the total ad pie at Rs 18,883 crore, against Rs 16,860 crore last year.

Print advertising, which stands at Rs 14,248 crore and is the second-largest contributor to advertising in India, will see 8.5 per cent growth, compared with 4.6 per cent last year, ending the year at Rs 15,459 crore. This growth, Srinivas said, would be led by regional advertising in newspapers, as companies in sectors such as telecom, fast-moving consumer goods, retail and automobiles increasingly targeted tier-II and III markets. “This trend has been visible for some time now,” Srinivas says, adding, “There will be acceleration this year.”

The outdoor, retail, radio and digital segments would also grow more than last year, he said. Outdoor will grow nine per cent, retail eight per cent, radio 10 per cent and digital 35 per cent.

This year, niche music and sports channels will split the advertising audience, which has largely gravitated towards cricket, Bollywood and English music, said Suku Murti, managing partner, GroupM ESP.

GroupM estimates the market for mobile advertising will grow, as will instream advertising — the constant feeds platforms such as Facebook and Twitter throw up at brands.

)