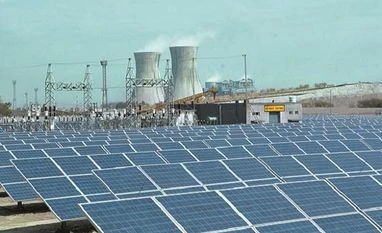

For years, the first page of the investor presentations of NTPC, India’s largest power company, carried images of its mega thermal power plants. In the August 2020 presentation, those images were pushed to the side, and a photo of a sapling appeared, along with the tagline —‘generating growth for generations’. If imagery is anything to go by, this marks a major change in the business plans of the country's energy companies — from rampant capacity addition to sustainable development.

What’s driving the change is also the fact that global financers and lending agencies are reducing their exposure to fossil fuels. In keeping with the trend, and to attract capital, energy companies are going green and switching tracks from thermal to clean energy sources.

NTPC, which first ventured into renewable energy in 2012, told investors earlier this month that it was planning to have a “30 per cent of non-fossil fuel basket by 2032”.

By then, it also wants to become a 130 GW company — from 62 GW currently.

In its investor call in April, NTPC’s management said, “While we will continue to add coal plants, ultimately, we have to go at a higher speed on the renewables side.”

Private power producers, too, have taken a strong stand against coal-based power plants. For instance, JSW Energy and Tata Power do not plan to add any further thermal capacities.

Last month, Sajjan Jindal-promoted JSW Energy said that it had set a carbon-neutral target, to be achieved by 2050. The company plans to retire or hive off its coal-fired plants by then.

Global fund manager BlackRock announced this January that it would divest all of its thermal coal exposure “due to its exceptionally high carbon intensity, regulatory risks and the loss of economic viability”. In India, BlackRock has significant investments in Coal India, NTPC and Adani Enterprises, among others.

That’s not all. Almost 20 sovereign funds, asset managers and pension funds globally have announced divestment from coal mining and coal-based power plantsand the fossil fuel industry, according to the data compiled by US-based Institute for Energy, Economics and Financial Analysis (IEEFA).

Praveer Sinha, managing director and chief executive officer at Tata Power, said, “Foreign banks are refusing to fund thermal, which makes large amounts of money available for renewable energy.”

The company wants to use the infrastructure investment trust (InvIT) route for its renewables portfolio expansion.

Among private companies, Adani Enterprises was the first to announce a significant shift towards the clean energy sector.

Gautam Adani, chairman, Adani Enterprises, in a LinkedIn post in January announced that the Group would invest over 70 per cent of the budgeted capex of its energy vertical into clean energy and energy-efficient systems. “We will achieve our target of 25GW by 2025. This will help India achieve its COP21 targets much before the deadline of 2030, and from the Group’s point of view, we will become carbon neutral,” said an Adani Group spokesperson.

In an earnings call, Prashant Jain, joint managing director and chief executive officer for JSW Energy, said, “In the next three to five years, we will be a 10 GW company, which we were earlier spelling out as a mix of thermal and renewable. But now we will achieve this in the renewable space.”

Last week, JSW Solar won an 810 MW ‘wind blended solar’ power project in an auction held by the Solar Energy Corporation of India (SECI) at a tariff of Rs 3 a unit.

Tata Power, too, is targeting a 60 per cent renewable portfolio by 2025, to be upped to 75 per cent by 2030 and an entirely non-carbon portfolio by 2050. Currently, clean energy accounts for 30 per cent of Tata Power’s portfolio. “We are going all out for renewables, including solar pumps, micro grids and so on, and want to become the top player across the value chain,” Sinha from Tata Power said.

Tata Power’s planned InvIT has about 2.6 GW of operating plants and 1.5 GW of capacity in the pipeline, taking the total capacity to 4.1 GW. The company said that apart from adding capacity in renewables in the next five years, it will also scale up its solar cells and module manufacturing business, along with the solar EPC business. Rupesh Sankhe, vice president with Elara Capital says, “We do not expect new private sector capacity addition in the thermal sector, and NTPC is also slowing down capex in thermal generation. Capital expenditure for renewables is lower on a MW basis —- at Rs 4 crore as against Rs 5.5 crore for thermal."

Sinha adds that the returns from renewables should be equal to or better than that from thermal power generation. Industry analysts agree that green energy will offer stable returns over a 20 to 25-year horizon.

Among foreign companies invested in India, Sembcorp Energy India Ltd (SEIL) is sticking to its global carbon target and measures for sustainability. Vipul Tuli, managing director, SEIL, told Business Standard: “The recent successful commissioning of the entire 800MW of generation capacity, won in our three SECI wind projects, is an example of our focus on renewables. With this, Sembcorp now has the largest operational capacity of SECI wind projects in India.”

However, Tuli said that the next level of renewable energy growth in India would require a fresh set of reforms. “These will need to recognise the true cost of renewables by making subsidies explicit, since the policy of passing on the costs of interstate transmission and intermittency onto conventional generators and Discoms now appears to have run its course,” he said.

Investment in a robust transmission network for handling solar and wind energy and financially strong power distribution companies would now be needed as India adds mega renewable capacity. Or, as Tuli sums it, affordability, reliability and sustainability will all need to be balanced through our energy transition.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)