On the second anniversary of N Chandrasekaran’s (Chandra, as he is popularly referred to) appointment as Tata Sons chairman, the owner and promoter of India’s largest private sector business group seems more dependent on Tata Consultancy Services (TCS) to keep the group finances on an even keel.

In the last two years, Tata Sons has earned around Rs 33,000 crore by way of equity dividend and share buyback from TCS, more than it earned from the company in the previous five years. Nearly two-thirds of this amount came from TCS’ share buyback in 2017 and 2018.

Before becoming group chairman, Chandra was heading information technology (IT) services major TCS as its managing director (MD) and chief executive officer.

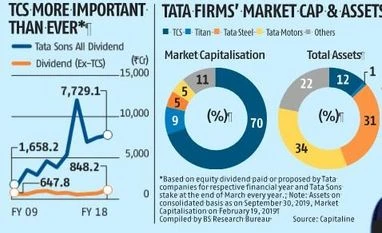

In 2017-18, TCS accounted for nearly 91 per cent of all dividend income that Tata Sons received from various listed group companies. The ratio was around 85 per cent in 2013-14 and just 60 per cent in 2008-09, the year after the Lehman crisis. The holding company also netted around Rs 11,763 crore by surrendering a part of its stake in TCS’ share buyback programme in 2017.

This dependence on TCS is making analysts somewhat concerned. They say it makes Tata group vulnerable to a sharp slowdown in the global economy. “The volume growth in global IT services business is now down to low single digits, making it tough for India’s technology companies such as TCS to grow fast. Industry growth could decline further if the global economy slows down later this year and the next year as anticipated,” says G Chokkalingam, founder and MD, Equinomics Research & Advisory Services.

Chokkalingam has a point. A large upside in Tata Sons income from TCS has come by way of the latter dipping into its cash reserves rather than faster earning growth. For example, the TCS payout in 2017-18 (FY18), including share buyback, was greater than its profits, forcing the company to plough into its cash reserves. In the first nine months of the current fiscal year too, 90 per cent of its profits have been distributed by way of share buyback and dividend.

This limits the ability of Tata Sons to earn an ever larger income from TCS to fund the capital requirement of cash guzzlers in the group. In FY18, for example, Tata Sons is estimated to have earned Rs 6,881 crore as dividend income from TCS. Its second-largest source was Tata Steel at Rs 306 crore, followed by Tata Chemicals at Rs 131.5 crore.

This has kept Tata Sons’ coffers flowing despite a steady decline in dividend income from other key group companies. For example, Tata Motors skipped the dividend payout for FY18 as it battles poor profitability at its Jaguar Land Rover unit.

Tata Motors is the largest Tata company, accounting for a little over a third of the group assets and 45 per cent of the combined revenues of all listed group companies.

Tata Steel, the group’s second-largest firm, in terms of revenues and profits, paid more dividend 10 years ago than now. Similarly, the dividend payout by Tata Power - the third-biggest company, in terms of assets, has remained unchanged for the last four years.

Tata Sons reported its highest-ever revenues of Rs 32,730 crore in FY18, of which Rs 7,569 crore came from dividend income and another Rs 19,816 crore came by way of profits on sale of investment, including surrender of TCS shares during the buyback.

In the current fiscal year so far, TCS has contributed around Rs 14,786 crore to its parent by way of interim dividend and share buyback. No other Tata company has declared interim dividend during the current fiscal year so far, nor has there been a share buyback by any other Tata company.

TCS, Titan Company, and Voltas are now the only group companies that have seen a steady increase in dividend payout in the last few years. However, the dividend amount paid by the latter two firms is still too small to move the needle. Besides, Tata Sons only owns 20.85 per cent of Titan and 26.64 per cent of Voltas, limiting its upside from these two companies. In contrast, in TCS, it owns 72 per cent stake.

Titan is now, however, the second-most valuable company in the group, accounting for nearly 10 per cent of the combined market capitalisation of all group companies and ahead of much bigger companies such as Tata Motors, Tata Steel, and Tata Power.

To put it differently, the two companies – TCS and Titan – account for just 13 per cent of group’s assets (or investments) now, while they take up nearly 80 per cent of all market capitalisation.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)