Non-banking financial companies (NBFCs), focused on automobile financing, are expected to witness good credit growth, on the back of robust automobile sales, especially commercial vehicles (CV), and expectations that the recent trends will continue.

The government focus on infrastructure, rural areas and macro environment will lead to 300 basis points (bps) rise in vehicle finance growth to 15 per cent over the FY18-20 period, compared to 12 per cent over the previous three financial years, according to CRISIL Ratings.

Credit growth in this segment has also been strong in FY18. According to ICRA Research, NBFC retail credit grew 16 per cent over a year in the first half of FY18 to Rs 6.6 trillion, against 15 per cent in FY17. Vehicle finance share is at 50 per cent of overall NBFC retail credit, which includes commercial vehicles, passenger vehicles, two-wheeler, three-wheeler, tractor, construction equipment and used-vehicles.

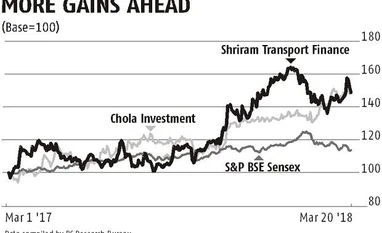

Major NBFCs, serving the automobile finance sector, such as Cholamandalam Finance, Shriram Transport and Indostar Capital Finance, are optimistic about the sector for the next 3-5 years and should benefit from the higher demand.

N Srinivasan, executive vice-chairman & managing director, Cholamandalam Investment and Finance Company, believes while all segments within the automobile space are growing in value terms, CV growth will be higher.

Analysts at Systematix Institutional Equities say the broad-based demand trend for the CV segment is led by higher infrastructure activity, firm freight rates across trunk routes, mining-led demand in eastern part of the country India and strict implementation of overloading norms in few states.

Within CVs, light commercial vehicle growth is strong, led by traction in sectors such as fast-moving consumer goods (FMCG), e-commerce and growing demand for refrigerated trucks. Demand for the used-vehicle segment, too, remains strong and positive from the lender’s perspective, as the segment offers higher margins.

More From This Section

Chola Vehicle Finance had disbursed Rs 81.14 billion in the first half of FY18; 70-72 per cent of Chola's total assets under management (AUM) come from vehicle finance.

Growth in the December quarter for the vehicle finance business was 26 per cent. However, given higher operational costs, Srinivasan believes the company needs to innovate and bring it down by automation and use of technology. The company reported margins of 9.6 per cent in the first 9 months of FY18. It is looking to maintain that.

Umesh Revankar, MD & CEO, Shriram Transport Finance (STFC), says while the CV sales were at peak in 2012, the downturn that followed has created a pent-up demand. Now, good monsoon, reasonably good economy and government spending on infrastructure are expected to boost sales. He expects sales over the next three years to be strong, both in rural and urban areas. Leapfrogging from BS IV to BS VI would require heavy investment by the automobile companies, which might reflect in higher prices for vehicles but the used-vehicle segment has a steady price, which will help maintain margins.

“For us, it is a positive situation till 2022, unless there are some surprises in the economy,” he said.

STFC expects 18-20 per cent growth for NBFCs and 15 per cent for the automobile-lending segment.

R Sridhar, executive vice-chairman and CEO, IndoStar Capital Finance, has said the industry is expected to grow 14-15 per cent till FY20. New policies may push CV demand but we may also see a huge demand for used-vehicles for captive use in different businesses,” he added. The company is focusing on the used-vehicles business.

In terms of segments, 85 per cent of NBFC vehicle finance portfolio comprises CVs and cars/utility vehicles (UVs) financing. CV financing, constitutes 51 per cent of the vehicle finance portfolio of NBFCs, is expected to rebound and clock a CAGR of 15 per cent till 2020. NBFCs would retain their market share of 65 per cent in the overall CV finance market. Cars and UV financing, constitutes 34 per cent of overall the NBFC vehicle finance portfolio, is expected to clock a CAGR of 18 per cent over the next three financial year, on the back of higher disposable incomes.

Margins are higher in used-CV financing product compared with new-CV financing. The gross spread of NBFCs is in a range of 7 to 8 per cent for used-CVs, compared with 2 to 3 per cent for new CVs.

According to experts, the gross non-performing assets of the auto finance sector is 6.7 per cent, comparatively lower than microfinance, infrastructure finance, and slightly higher than housing finance, loan against property and gold loans, among others.

)