The government has invited global and Indian companies to submit expressions of interest (EoIs) by April 30 for setting up display fabrication units in the country. The units will produce LCD, OLED, AMOLED or QLED based displays.

At present, India is dependent on imports for these products.

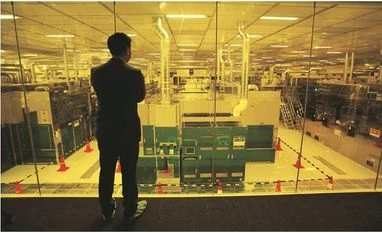

A display fabrication plant manufactures the screens through a complex method, which includes sandwiching pieces of glass with transistor cells and use of metal alloys and silicon. This requires a minimum investment of over $2 billion. Such plants assemble the glass with other components required to power the screen. Most such plants also have an assembly unit.

According to experts, the technology is held by a select few companies in China, South Korea, Taiwan, and Japan. China dominates the LCD market with over 70 per cent share and Chinese firms have invested $50-70 billion. The premium OLED market is dominated by Samsung and LG, but the Chinese have made major investments here too. The other leading players include Chinese companies like BOE Display and TCL and Taiwanese firms like Innolux and Japanese companies like Toshiba and Sharp amongst others.

In India, however, there are some assembly units that include Chinese players like Holitech, which import the glass. Samsung is also reportedly putting up a display plant in Uttar Pradesh, primarily for mobile devices, at an investment of around Rs 5,000 crore, but the details are not known.

The Ministry of Electronics and Information Technology (MeitY) has said it will likely formulate a scheme for setting up display fabrication units in the country based on the information in the submissions. The move comes in the wake of the government’s flagship production-linked incentive (PLI) scheme, which is aimed at making India a hub for exports and to increase value addition in electronics.

Setting up a display fabrication unit is key to India’s aim to become Atmanirbhar. That’s because China is increasingly dominating the space across segments, building huge volumes. Without a domestic manufacturing facility, India might have no choice but to depend on the Chinese.

An executive of the India Cellular & Electronics Association (ICEA) pointed out that big Indian business houses with deep pockets could possible get technology from the Japanese and Taiwanese and form joint ventures with them. The executive said: “However, because of the huge minimum investment required, any manufacturing plant has to cater not only to Indian needs but for exports across the globe. So, it has to be competitive. Across the world, in such strategic areas, the government has to come in and help. And that is key.”

According to MeitY estimates, the market for displays in India is pegged at $7 billion, but is expected to more than double to $15 billion by 2025, especially with the expected boost in production and exports of mobile devices, laptops etc. For instance, it points out that displays account for 25 per cent of the material cost of a mobile device, while it is as high as 50 per cent for LCD and LED television sets.

MeitY also says the electronics manufacturing sector has been suffering because of a 10 per cent cost disability. Given the capital intensive nature of display manufacturing, there is a need for incentivising the industry to set up display fabrication facilities.

Prospective applicants, says MeitY, should either possess relevant IP and technology or one of the partners should in case of a joint venture. Else, the applicant should show intent to enter a purchase agreement with a firm that has the technology.

The second qualifier is that that the applicant should also have five years’ experience in running a commercial display fabrication facility. In case the firm enters a purchase agreement for the technology, the latter should have an experience of five years.

The applicant needs to give a preliminary project report of plans, investment, technology specifications and support it desires from the central and state governments to set up the unit. These could be grants in aid, viability gap funding in the form of long-term equity, long-term interest-free loans, tax incentives, regulatory waivers and infrastructure support. From the states, firms could ask for capital subsidy, land value discounts in water and power tariffs amongst others.

To reduce import dependence, the government has already introduced a 10 per cent duty on smartphone displays and touch panels. However, the move was criticised as mobile device manufacturers said it would increase the price of phones, especially as there are no Indian players manufacturing displays at present.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)