The fund, backed by the Housing Development Finance Corporation (HDFC), had planned a tenure of 10 years for the proposed fund and it was looking at equity deals apart from structured debt deals.

"They are looking to exit $600 million from their first offshore fund by March 2016 and are currently talking to developers for exits. That is their priority," said the executive.

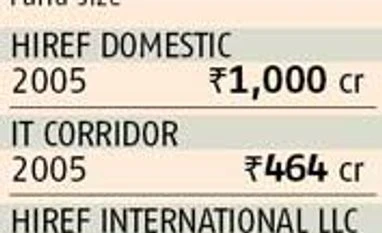

HIREF International is a $800-million, nine-year offshore fund, raised in 2007.

The fund is looking to exit two projects of property developer Lodha group in Mumbai and Hyderabad by December 2015, the executive added.

HDFC Property Fund executives could not be contacted for comments. An e-mail from Lodha group denied the talks, saying that "there are no such deals under negotiation."

According the executive quoted above, HDFC Property Fund is looking for over two times returns from its Rs 500 crore investment in World One, a 117-storey luxury residential tower in central Mumbai and part of World Towers project in the same area. The investment was made in 2009.

However, a private equity fund manager, who did not want to be named, said HDFC Property Fund was treading cautiously given that it took one-and-a-half years to raise its last offshore fund and had to prune the fund size from $500 million to $375 million due to tough market conditions and wary investors. The fund manager said even Piramal Fund Management's plan to close a $150-million offshore fund by April was delayed as limited partners' investments became slow.

"Though private equity has made a come back in India, blind pool fund raising remains a tough task and investors are more interested in traction-based deals and platform investments," said Amit Goenka, managing director and chief executive officer, Nisus Finance Services.

)