A top official said the firm is looking at funding to cash in on the infrastructure boom expected in the next 24 months due to the multi-billion orders expected from the Indian government in the power, roads and railways sectors. According to an estimate, the government would give orders worth Rs 5 lakh crore in the next few years in the infrastructure sector alone. Apart from raising funds at the holding company level, the firm has three listed subsidiaries and special purpose vehicles - which are also raising funds at their own level. "The fund-raising exercise is a continuous process," said a top official. IL&FS Tranportation Networks is in the process to raise Rs 740 crore by way of a rights issue, which is opening on October 23. Analysts said IL&FS' investments in group companies is the mainstay of its balance sheet and it is focusing on sourcing long-term funds to replace maturing obligations.

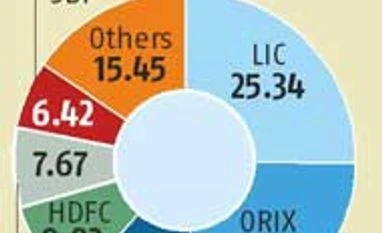

Besides, IL&FS acts as the main group treasury and liquidity operations and the group continues to maintain an asset light policy, which helps it from an asset liability management perspective. Life Insurance Corporation of India (LIC) owns a 25.94 per cent stake in it, while Japanese firm Orix Corp holds 23.59 per cent. There were reports the firm's promoters were in talks with the Piramals for a possible all-stock merger. According to reports, the merger with Piramal Enterprises was to result in the company getting fresh equity funding, which is likely to be used to repay loans. As of FY14, IL&FS debt was Rs 7,237 crore on a standalone basis. IL&FS and Piramals have declined to comment on the possible merger.

)