The Indian pharmaceutical industry appears to be in the line of fire. The country’s drug companies have attracted the highest number of enforcements from the American drug regulator in 2013, a year that has seen the US Food and Drug Administration (FDA) turning stricter to ensure compliance levels and quality of medicines.

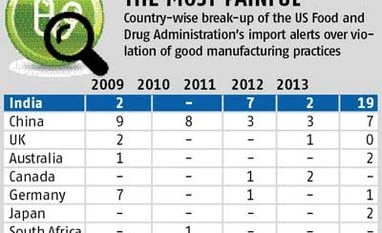

According to FDA data, so far this year, as many as 19 drug manufacturing factories across India were barred from supplying medicines to the US, the world’s largest drug market. The restrictions include the import alerts imposed recently on the facilities of Ranbaxy, Wockhardt and RPG Life Sciences. In the same period, Chinese drug manufacturing facilities faced seven FDA import alerts; Australian, Canadian and Japanese ones two each; and South African and German units one each. There were no alerts on those in the UK. Also, Israel, a major supplier of generic drugs with companies like Teva, does not figure in the FDA’s drug import alert list at all.

For India, compared with preceding years, the number has gone up significantly only in 2013, indicating a possible change in the regulator’s stance. For instance, domestic manufacturing facilities received merely two import alerts in 2012. In 2011, while there were seven import alerts, most were issued to active pharmaceutical ingredient or raw material manufacturing plants. Aurobindo Pharma, for its Hyderabad facility, was one of the major companies that received an alert in 2011. In 2010, there were no US import alerts in India. In 2009, Ranbaxy’s two facilities — at Paonta Sahib (Himachal Pradesh) and Dewas (Madhya Pradesh) — were the only units to be barred from supplying medicines to the US.

Experts say, the growing share of Indian firms in the US generic market, besides the FDA’s increasingly stricter compliance norms and procedures, could have caused the sudden rise in enforcements, triggering concerns among stakeholders.

“FDA does not have enmity with Indian pharmaceutical manufacturers. In fact, US depends largely on India for supply of low-cost generic medicines. But, as India is gaining a bigger foothold in the generic market and as the penetration is increasing, companies here will be subject to a greater scrutiny. There is competition and FDA is under pressure to ensure that quality medicines reach patients,” says Sanjiv D Kaul, an industry veteran and managing director of ChrysCapital.

According to FDA data, so far this year, as many as 19 drug manufacturing factories across India were barred from supplying medicines to the US, the world’s largest drug market. The restrictions include the import alerts imposed recently on the facilities of Ranbaxy, Wockhardt and RPG Life Sciences. In the same period, Chinese drug manufacturing facilities faced seven FDA import alerts; Australian, Canadian and Japanese ones two each; and South African and German units one each. There were no alerts on those in the UK. Also, Israel, a major supplier of generic drugs with companies like Teva, does not figure in the FDA’s drug import alert list at all.

For India, compared with preceding years, the number has gone up significantly only in 2013, indicating a possible change in the regulator’s stance. For instance, domestic manufacturing facilities received merely two import alerts in 2012. In 2011, while there were seven import alerts, most were issued to active pharmaceutical ingredient or raw material manufacturing plants. Aurobindo Pharma, for its Hyderabad facility, was one of the major companies that received an alert in 2011. In 2010, there were no US import alerts in India. In 2009, Ranbaxy’s two facilities — at Paonta Sahib (Himachal Pradesh) and Dewas (Madhya Pradesh) — were the only units to be barred from supplying medicines to the US.

Experts say, the growing share of Indian firms in the US generic market, besides the FDA’s increasingly stricter compliance norms and procedures, could have caused the sudden rise in enforcements, triggering concerns among stakeholders.

“FDA does not have enmity with Indian pharmaceutical manufacturers. In fact, US depends largely on India for supply of low-cost generic medicines. But, as India is gaining a bigger foothold in the generic market and as the penetration is increasing, companies here will be subject to a greater scrutiny. There is competition and FDA is under pressure to ensure that quality medicines reach patients,” says Sanjiv D Kaul, an industry veteran and managing director of ChrysCapital.

The share of other major generic drug manufacturing countries, such as Japan, Israel and China, is much lower, analysts suggest. For instance, though China is a major supplier of APIs to the US, most of those either go through India, where it is used in formulations, or to generic formulation manufacturers in the US. “So, in terms of value, China does not have a significant share of the US markets,” says an industry analyst.

Also, India is among the first countries, apart from China, where FDA has set up offices. In March, India also allowed the FDA to add seven inspectors, bringing its staff in the country to 19, reflecting India’s growing importance as a supplier to that country.

FDA’s increased presence could also be one of the reasons for Indian drug makers coming under closer scrutiny this year, the analyst said.

)