Equity dividend paid by the country's top listed companies has more than tripled in the past five years, despite only a 50 per cent increase in their combined net profit during the period.

The sample comprises 144 companies, which have declared their results for the fourth quarter of the financial year ending March 2016, as well as Indian listed subsidiaries of foreign multinationals such as ACC, Ambuja Cement and ABB, among others, whose financial year ended on December 2015.

These companies will pay Rs 61,087 crore in equity dividends to their shareholders for FY16, an increase of 19.2 per cent year-on-year compared to Rs 51,262 crore in FY15. In comparison, their combined net profit is up only 5.7 per cent year-on-year in FY16.

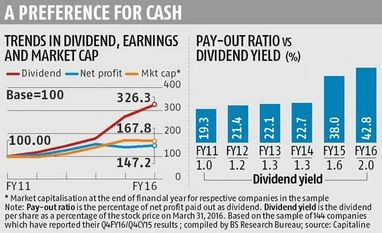

This has resulted in a steady rise in corporate India's payout ratio - share of current year profits distributed as equity dividends.

In FY16, companies in the sample will share 43 per cent of their net profit as dividend, up from 38 per cent in the previous year and 19.3 per cent in FY11. In FY15, BSE 500 companies had together paid equity dividend of Rs 1.45 lakh crore.

The combined dividend payment by these 144 companies has clocked a compounded annual growth rate (CAGR) of 26.7 per cent during the past five years, which is more than thrice the underlying growth in earnings.

The combined net profit for the sample grew at a CAGR of 8 per cent during the period.

A similar trend is visible in the historical data for the S&P BSE Sensex 30 companies, though less pronounced. In the last five years, the underlying dividend pay-out by the index companies has grown at a CAGR of 13 per cent, against 7.5 per cent CAGR growth in their underlying earnings per share during the period. Sensex companies now pay around 30 per cent of their net profit as dividends up from around 22 per cent in April 2011.

Anil Agrawal controlled Hindustan Zinc is the biggest payer in FY16 taking over the mantle from Tata Consultancy Services (TCS) which in turn had overtaken Coal India last year in the dividend league table. The zinc maker is paying a total equity dividend of Rs 21,887 crore, which is more than two-and-a-half times its net profit of Rs 8,167 crore for FY16.

A total of three companies are paying 80 per cent or more of their net profit in FY16 as equity dividends.

Such a high pay-out ratio means that companies are dipping in their cash reserves to pay dividends. "Whenever a pay-out ratio crosses 80 per cent, a part of the dividend comes from past profits or accumulated cash reserves. A typical company needs to retain at least a fifth of the profits to fund current operations," said G Chokkalingam founder & chief economic office, Equinomics Research & Advisory.

In all, 91 companies in the sample declared equity dividends in the FY16. Out of this, in terms of absolute dividend payment, 41 companies paid higher dividend, while 31 companies are paying the same amount and 19 have announced a cut in dividend outgo, compared to the previous year. Another 12 companies are not paying any dividend at all this year, though they had paid last year.

Market experts say that corporate India's dividend generosity has been a saviour for investors and promoters. "Poor corporate earnings have hit the finances and cash flows of many investors, especially high net worth individuals and promoters. Higher dividend outgo has been a boon for them," said Chokkalingam.

For example, large dividend pay-out by TCS has been central to the financial flexibility of Tata Sons, country's largest promoter and holding company in the private sector.

This year Vedanta's finances will get a boost from the large dividend income from Hindustan Zinc, its subsidiary. In the past, the government of India, too, has used special dividends from cash rich companies such as Coal India to plug holes in public finances.

A higher dividend has also supported valuations on the Dalal Street. In the last five years, the combined market capitalisation of the companies in the Business Standard sample has grown at a faster pace than the underlying earnings, making stocks expensive on price to earnings (or PE) multiple ratio. But thanks to higher dividends, stocks are now cheaper on basis of dividend yield than five years ago.

The risk is that companies cannot sustain higher outgo year-after-year in the absence of a faster earnings growth. This explains why ap between the rise in underlying dividends and share price.

)