Chief executive officers (CEOs) are citing rising interest rates, lack of demand. high debt hangover and uncertainty over the general elections’ outcome as the main reasons.

“There is nothing happening on the ground. Barring expansion of capacity by Reliance Industries in Gujarat, no other corporate group is investing in new projects. They are all in wait-and-watch mode due to the elections,” says a top official of construction major Larsen & Toubro, asking not to be named. It will take another six months before work on any new project begins, he said.

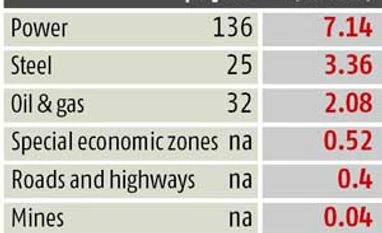

The number of projects stalled or abandoned are at a record high of 11 per centof those cleared by the government and has been rising since 2010. The stalling is majorly due to environmental and other governmental clearances, land acquisition and raw material availability, including those of coal and other minerals. The naming of top companies, including the Tatas and Birlas, in various scams has further dampened the mood.

A Birla official said the group was expanding capacity in the cement business but no new projects were being planned. “We will wait till the elections to decide on our next big project. Till then, the group will only work on the existing projects,” a Birla official said.

Another problem faced by the Indian corporate sector is high leverage. A study by JPMorgan year says a plethora of companies levered up significantly over the past decade, under the assumption of continuing nine per cent yearly growth, without anticipating the implementation bottlenecks that were to follow. And, the combination of lower growth, rising interest rates and on-the ground bottlenecks meant several of these projects became unviable and firms had difficulty servicing and repaying the debt. This problem is faced mainly by infrastructure companies -- exampled are Jaypee, Lanco, GVK, GVR. These have very high debt on their books and have been advised by banks to sell assets to reduce their loan burden.

JPMorgan says the sharp slowing in revenue growth and margin pressures have resulted in negative operational cash flows of 22 per cent of the BSE 500 companies (excluding financials) over FY13. Financial leverage is adding extra pressure on these companies’ balance sheet.

Not surprisingly, the economic unavailability of certain projects and sectors—along with depressed market conditions—has made it harder for companies to raise equity. debt/equity ratios are currently at 15y-year highs and non-performing assets and restructured loans have begun to pile up in the banking sector.

Analysts say banks have become increasingly risk-averse and appear happier parking their assets in government securities. The share of the latter, at 29 per cent of net demand and time liabilities, is significantly higher than what is mandated (23 per cent) as statutory liquidity ratio.

)