The June quarter numbers have shown business environments are fragile and can swing a company’s performance in either direction.

In the first quarter (Q1) of 2016-17, the Bengaluru-headquartered company has for the first time in a year missed its prior revenue estimates, apart from having to cut it annual forecast in this regard, sparking strong reactions from investors.

At the end of Friday's trading, Infosys shares were down 8.8 per cent to Rs 1,072.25, the sharpest fall since April 12, 2013. In the quarter ended June, Infosys, which counts Bank of America, Citibank, Volvo and Apple among clients, reported Rs 3,436 crore in net profit, growth of 13.4 per cent over the corresponding period a year before.

Revenue at Rs 16,782 crore grew 16.9 per cent over a year, though it missed the consensus growth estimate. One by Bloomberg, based on a survey among analysts, had pegged Infosys' net profit at Rs 3,436.9 crore and revenue at Rs 17,034.9 crore.

"We had unanticipated headwinds in discretionary spending, in consulting services and package implementations, as well as slower project ramp-ups in large deals we'd won in earlier quarters, resulting in a lower than expected growth in Q1,” said Vishal Sikka, managing director and chief executive. The implementation strategy, he said, was on track and they expected strong growth in large deals.

In terms of sequential (quarter on quarter) growth, net profit declined 4.5 per cent, while revenue grew 1.4 per cent.

“While the TCS growth numbers were broadly in line, Infosys' constant currency 1.7 per cent growth is sharply lower then the estimate,” said Rikesh Parikh, vice-president at M·otilal Oswal Securities, in a note after the results. “Over last year, we had seen the valuation gap between TCS & Infosys reduce, largely due to better growth of the latter. Pprobably, after this quarter, the gap could increase.”

Infosys has now cut its annual revenue forecast at the top end by 150 basis points (bps, meaning 1.5 percentage points) and at the lower end by 100 bps. The company said it is now expecting its revenues to grow between 10.5 per cent and 12 per cent in constant currency, as compared to the 11.5-13.5 per cent it had given at the beginning of the financial year.

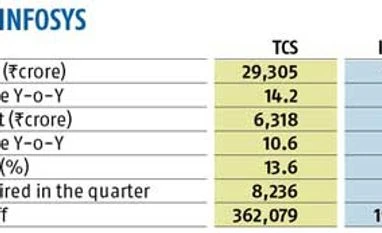

In terms of profitability, Infosys reported a 140 bps decline in operating margin to 24.1 per cent on a sequential quarter basis, higher than TCS. This was primarily due to the seasonality associated with a rise in pay and compensation costs. In the same period, TCS’ operating margin declined by 98 bps to 25.1 per cent, reflecting better cost management.

The growth in billed manhours during the quarter, also known as volume growth, was 2.2 per cent in the case of Infosys, lower than TCS’ 3.4 per cent. Volume growth is one of the important parameters to measure actual work.

In terms of regions, Infosys saw good growth in North America, up 2.4 per cent sequentially in constant currency. The rest of the world (excluding Europe, where growth was flat) grew 4.9 per cent. With TCS, the constant currency growth in North America was better at 2.8 per cent. It also grew in the UK and in continental Europe, at 3.8 per cent and 8.5 per cent, respectively.

After managing to keep the employee attrition rate under control for some quarters, it rose in this one for Infosys by 370 bps, to 21 per cent (including that in business process outsourcing). In the case of TCS, though the rate went up, it was well within control at 13.6 per cent.

Analysts say most of the operating parameters are still healthy. “Q1 has been disappointing (for Infosys) but this has come after a couple of good quarters. The year-on-year constant currency growth of 10.9 per cent is healthy and the FY17 growth guidance also implies an above-industry growth rate,” equity analyst firm Prabhudas Lilladher said.

)