This means Wipro will have to grow its topline an average of 23 per cent every year from $7.08 billion in 2014-15. This year, the firm is expected to earn $7.5 billion in a technology services market that is witnessing turmoil as clients in the United States and Europe cut spends due to business uncertainty.

"Amidst macro-economic headwinds and the secular shift of organisations moving toward the as-a-service economy, Wipro's targets are certainly ambitious," says Tom Reuner, managing director for IT outsourcing research at HfS. "The market is growing significantly less than the guidance by Nasscom."

The industry lobby group expects the $108 billion industry to grow 10-12 per cent in 2016-17, slower than the current financial year.

A lot of ground to cover

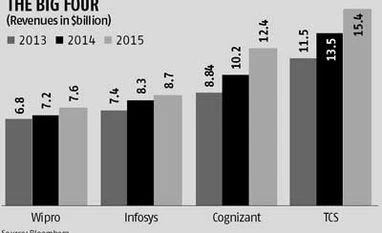

For Wipro, the task of doubling revenue becomes harder if you look at its track record over the last five years. The Bengaluru-based company has lagged behind peers such as Tata Consultancy Services, Infosys and Cognizant, the US-based IT services firm that follows the business model of India-based firms.

The banking, financial services and insurance vertical, a high growth segment for Indian outsourcers, contributes 26.2 per cent to Wipro's total revenue, compared to 33.5 per cent for Infosys and 40.5 per cent for both TCS and Cognizant. However, as Cognizant announced recently, there are headwinds in this sector too. Neemuchwala has his task cut out and he is aware of it. "The biggest challenge is to rally people. Everybody has to have the same sense of purpose of what we're trying to do. The biggest struggles are in the human mind," he said in a recent interview. "I don't want to underestimate that, it's 160,000 people in 90 different countries. Second is we have a huge legacy, we're a 45-year-old company, so we have habits that are 45 years old."

Bringing fresh energy

It was in 2014 that both Infosys and Wipro looked outside the company to hunt for a CEO. Infosys picked Sikka, a former board member of German business software firm SAP AG, to run the company.

Wipro got Neemuchwala, who was heading the back office arm of larger rival TCS as its chief operating officer, even as it explored hiring other candidates from the industry. The clincher was his track record of execution.

"Neemuchwala brought a very different DNA (to Wipro). He is unassuming and has a track record of strong execution. What we need in the future is not strategy. I think the phase for strategy is done. What we need is execution," TK Kurien, who has been elevated as the vice-chairman of Wipro, said in a recent interview. His mandate is to mentor Neemuchwala while handling the key customers globally over the coming year.

Neemuchwala is credited with building the back office arm at TCS, where the emphasis is on long term relations and customer service, while improving efficiency in delivery of services. He made this point to Wiproites on February 1, outlining his ambitious growth plans, saying it was grounded in reality.

"I have no doubt that we must begin to think like a start-up - where there is nothing from the past that is so sacred that it can't be questioned - and create a workforce that is a melting pot of diverse ideas. Plurality of ideas amid commonality of purpose is important," he said in an internal mail. This, analysts say, is Neemuchwala's signal to the world that he is ready to go the extra mile to achieve his goal.

Like Sikka, Neemuchwala is betting on areas such as artificial intelligence to drive growth faster without adding any headcount. In addition, he is also pushing the product engineering services unit that help organisations build products, to push Wipro earn higher margins than traditional services.

"If Wipro is able to both be an industry consolidator and master the new business models then it has a fighting chance to meet at least the growth goals. Having said that, a business as usual strategy in which Wipro attempts to grow faster through its existing strategies seems unlikely to get it anywhere close to these targets," says Peter Bendor Samuel, founder and chief executive of Everest Group, the global outsourcing services industry researcher.

"It will be interesting to see if Neemuchwala is given the tools to go after these aggressive goals."

Reuner of HfS seconds this. "One facet is that the guidance can be a conduit for change management. Investments in its Holmes platform and the recent acquisition of Viteos are indicators that the company is cognizant of the challenges ahead," he says. "But these and all other capabilities have to be sold. Given the challenging market environment, the necessity to transform the sales engine becomes even more critical."

If Neemuchwala can meet the ambitious target, he will have achieved a turnaround like none other.

)