With the domestic consumption of steel not picking up, they’ve not been able to pass on the input cost rise to customers. However, there has been a rise in output and export over 2016-17.

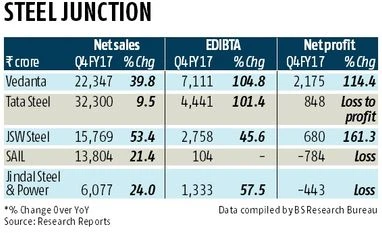

“Except Tata Steel, we expect companies to report a weak set of numbers in Q4 (the March quarter), as they were hit with a fall in steel prices in February and March, as well as higher coal cost,” said Elara Capital. JSW Steel is likely to be affected the most, hit with both higher coal cost and iron ore cost. Tata Steel India, however, imports only 67 per cent of its coking coal requirement.

“This would be a consecutive quarter when companies are facing margin contraction,” says IIFL. “Steel players were unable to pass on the increase in input costs due to resistance from consumers, de-stocking and subdued demand. As a result, margins would be squeezed further on a sequential basis.” However, the long-term picture is considered bright and stock prices of steel companies are expected to continue their upward trend. With long-term protection measures from cheaper import in place and as the latent demand for steel is expected to pick up in the domestic market after the monsoon, stocks will rally, say analysts.

Since imposition of a minimum import price in February last year, stock prices of nearly all major domestic producers have more than doubled, despite the higher raw material prices in the year gone by. Anti-dumping duty for some categories of import from China would be in place for five years.

Analysts say the rise in global iron ore prices augur well for most domestic steel producers, as they have captive ore supply, a reason for export to have more than doubled to 8.24 million tonnes in FY17, from four mt the previous year. Production was 11 per cent up at 101.27 mt.

And, as domestic steel producers also maintain an inventory of four to six weeks for coking coal, any fluctuation in fuel prices gets averaged out over a longer period, said analysts.

In the past two years, the global price of coking coal has surged four-fold, from $75 a tonne to $305 a tonne.

Though global steel consumption is picking up since January, last year was largely a range-bound demand pattern. In India, consumption rose three per cent in FY17 to 84 mt.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)