Trucks, arguably the most non-glamorous vehicles in the automobile industry, are undergoing an image makeover.

Anti-lock braking systems, cruise control and automated manual transmission, beside air-conditioned and comfortable cabins, are the features a number of manufacturers want to drive home. Backed by assurance of reliable and efficient performance that makes a business case for an owner, many of whom are now willing to pay more.

Volvo Eicher Commercial Vehicles (VECV) and Daimler India Commercial Vehicles (DICV) are trying to position their products on a life-cycle value concept. “Fuel is half of the operating cost for a vehicle owner; vehicle cost is only twenty per cent. If you get a 10 per cent higher mileage and are spending 10 per cent more on acquisition cost, you get a better deal over the lifetime of a truck. We are building awareness among fleet owners and individual buyers and a change is happening,” said Vinod Agarwal, managing director (MD) at VECV, the country’s third -biggest medium and heavy commercial vehicle (M&HCV) maker. It sold 28,600 medium and heavy trucks in FY17, growing seven per cent over the previous year when the industry declined by about one per cent.

Bal Malkit Singh of Mumbai-headquartered Bal Roadlines, which has a fleet of a little over 300 trucks, says the reliability and efficiency of trucks from companies like VECV and DICV are better. “We decided to keep them in our fleet, as it allowed us to discover the difference that they bring. We have also given feedback to the bigger brands,” he said. The bulk of the trucks owned by him come from Tata Motors and Ashok Leyland, the two top manufacturers.

However, resale could be an issue for these brands. A Tata Motors or Ashok Leyland truck is easily picked up in the second-hand market, he added.

Erich Nesselhauf, MD at DICV, said air conditioning was not a luxury in the case of trucks. “Since there is a shortage of drivers in the country, we must offer them comfort to retain them. Accidents are due to driver fatigue. When a driver is comfortable, he can drive longer hours. More fuel is consumed without an AC,” he added. One of every five trucks sold by the company is air conditioned.

Right from its India launch in 2012, DICV claims to offer crash-tested steel cabins which fulfil global standards. It also introduced an anti-lock braking system (ABS) as a standard feature before it became mandatory, while factory-fitted air conditioning has been available as an optional feature from Day One. DICV sold about 13,000 trucks under the Bharat Benz brand in India during the 2016 calendar year, with a marginal decline that it attributed to a ‘challenging’ market during the second half'. Other smaller foreign entities here are Scania and MAN.

S P Singh, an industry expert and advisor with CTC Logistics, which has a fleet of 550 trucks, said many large users such as refineries and miners realise the service these products from international players offer. “Refineries such as Cairn pay as much as Rs 3.5 lakh as monthly rent for a vehicle from Volvo and Scania, almost Rs 1 lakh more than what they pay for a Tata vehicle. The real cost per tonne-km is lower.”

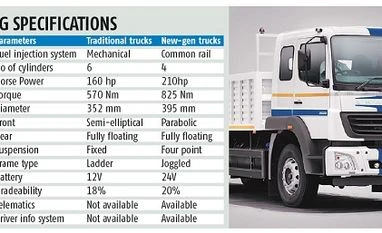

He said many buyers now value the reliability, safety and comfort features of these new entrants. “The days of steel on wheel will end in the coming years. You will see technology on wheelers,” he said, referring to some of the newer products. He said the technology of the smaller entities was superior and customers are ready to accept these, since the price gap is also lowering.

Siddhartha Lal, MD at Eicher, said the Indian CV market will see discontinuities. The 2020 BS-VI emission norm will be an enormous one. “People won’t be able to sell the old-style of trucks any more, I think, when GST (goods and services tax) comes in and roads will open up. You are not stopping at every naka (checkpoint) for paying some tax. If the roads open up and India becomes a truly single market, then the best truck wins. Otherwise, the best is stuck behind the slowest truck and then it also becomes the slowest. When you are not stuck in this queue, you will able to use the asset more productively.”

Fleet owners have started factoring in the value that certain vehicles deliver over their lifetime and not look at only the initial cost of acquisition and equated monthly instalment (EMI). “Buyers usually go for a four-year EMI for a truck and it comes to Rs 40,000 a month. But, with these trucks, one can easily opt for a six-year EMI and still pay Rs 40,000. That does not pinch but improves income,” said CTC’s Singh.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)