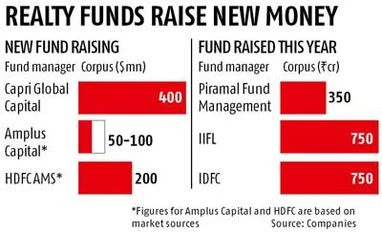

These funds include Lalbhai Group-promoted Amplus Capital, Capri Global Capital, and HDFC Asset Management Co, among others.

After its Rs 150-crore domestic fund, Amplus Capital is looking to launch an offshore fund of $50-100 million, sources said. However, when contacted, Amplus Capital's CEO Anuranjan Mohnot did not divulge any details, saying: "As a fund manager, we always look at new things. We can discuss that at an appropriate time."

Similarly, Mumbai-based Capri Global Capital, a non-banking financial company, is looking to launch a $400-million fund in the next two quarters. It is in the process of applying to the Securities and Exchange Board of India (Sebi), confirmed Viswajit Srinivasan, director at Capri Global Capital. The fund will focus on residential assets.

Capri Global Capital is engaged in wholesale lending and SME lending. It has done a strategic tie-up with US-based hedge fund Capri Capital Partners for using its name and other expertise.

"The company believes that housing, especially the affordable housing segment, offers a compelling proposition, given the huge demand for quality housing in India. The company is optimistic about being able to raise funds, so long as the overall strategy and the deployment focus is aligned to market expectations," said Sunil Kapoor, executive director, Capri Global Capital.

According to sources, HDFC Asset Management is also looking to launch a Rs 1,500-crore ($250-million) realty fund. Earlier, HDFC Asset Management had raised a Rs 4,000-crore fund and made several investments in the realty sector.

HDFC Asset Management executives could not be contacted for comments.

Notably, a number of fund managers raised real estate funds this year. Recently, Piramal Fund Management announced raising an apartment fund of Rs 350 crore, which will buy residential apartments from builders at discounts and already raised Rs 100 crore in the first 10 days of the launch. Similarly, IIFL and IDFC raised funds at the beginning of the year, with each fund having a corpus of Rs 750 crore.

However, Amit Bhagat, CEO and managing director of ASK Property Investment Advisors, has a word of caution for investors. "Though many fund managers are launching funds, it is important to look at their track record with regard to exits made, returns made, etc."

)