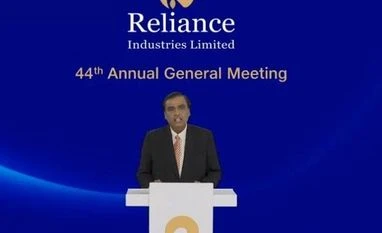

Reliance Industries chairman Mukesh Ambani told shareholders at the company's 44th AGM on Thursday that the country is in midst of humanitarian crisis owing to coronavirus pandemic.

"Our business and financial success since last AGM have exceeded expectations despite Covid pandemic. But what has given me far greater happiness than our business performance is RIL’s humanitarian efforts during these exceedingly difficult times," said Mukesh Ambani.

Even in a challenging environment, RIL’s performance continued to be outstanding. Consolidated revenue was Rs 5.4 trillion, consolidated EBITDA was Rs 98,000 cr, and almost 50% of EBITDA was contributed by consumer businesseses, added Ambani.

RIL’s contribution to Indian economy remained unmatched in FY21 – 6.8% of India’s merchandise exports, 75,000 new jobs, Rs 21,044 crore of customs plus excise, Rs 85,306 crore of GST plus VAT, and Rs 3,213 crore of income tax, he said.

RIL raised $44.4 billion – largest ever capital raise by any company in a year globally. "This capital raise is a strong vote of confidence by global investors in India’s growth potential," said Ambani.

Ambani also announced that Yasir Al-Rumayyan, Chairman of Saudi Aramco and Governor of PIF, will join the Board of Reliance Industries as Independent Director. "His joining our Board is also the beginning of internationalisation of Reliance," he said.

Harvard educated, Al-Rumayyan, 51, will replace Yogendra P Trivedi, 92, who has expressed desire to retire, Ambani said at the company's annual shareholder meeting.

On the sale of 20 per cent stake in the O2C business, he said the deal is likely to conclude this year.

"Continued engagement and resolve from both sides, even during this pandemic, is a testimony of strong relationship between Saudi Aramco and Reliance. I expect our partnership to be formalised in an expeditious manner this year," added Mukesh Ambani.

"Our O2C business faced unprecedented challenges by severe economic contraction at the beginning of year. Yet we were probably the only company globally that operated at near full capacity and was profitable in every quarter," added Ambani.

He also said the company rewarded its shareholders with the largest and the most successful Rights Issue ever by an Indian company. "Our retail shareholders have made 4x returns in just one year on their rights shares," added Ambani.

Ambani said the company aims to bridge the green energy divide in India and globally.

"As one of the biggest energy markets in the world, India will play a leading role in transforming the global energy landscape. We have established Reliance New Energy Council with some of the finest minds globally. We have started work on developing the Dhirubhai Ambani Green Energy Giga Complex on 5,000 acres in Jamnagar. It will be amongst the largest such integrated renewable energy manufacturing facilities in the world. We plan to build four Giga Factories to manufacture and integrate all critical components of New Energy ecosystem – solar photovoltaic module factory, energy storage battery factory, electrolyser factory, fuel cell factory," said Ambani.

"Over the next 3 years we will invest over Rs 60,000 crore in these initiatives. We will invest an additional Rs 15,000 crore in value chain, partnerships and future technologies, including upstream and downstream industries. Thus, our overall investment in New Energy business will be Rs 75,000 crore in 3 years," he said about the company's future plans.

Besides bringing his vast financial experience, the induction of Al-Rumayyan, who also sits on the board of SoftBank Group Corp and Uber Technologies, will bring down the average age of the board of directors of Reliance.

Over the past years, the oil-to-telecom conglomerate has segregated businesses into separate verticals - Jio Platforms houses the company's digital and telecom unit, retail is a separate unit and oil refining and petrochemical segments have been carved into the O2C sector to attract strategic partnerships.

Under Al-Rumayyan, PIF has invested billions of dollars in RIL ventures.

In June last year, PIF bought a 2.32 per cent stake in RIL's digital unit Jio Platforms for Rs 11,367 crore. Five months later, it picked up a 2.04 per cent stake in RIL's retail venture for Rs 9,555 crore. PIF has also invested Rs 3,779 crore in an infrastructure investment trust (InvIT), Digital Fibre Infrastructure Trust (DFIT) that holds RIL's fibre-optic assets.

"I am sure that we will immensely benefit from his rich experience of running one of the world's largest companies, and also one of the largest sovereign wealth funds in the world," he said. "His joining our board is also the beginning of the internationalisation of Reliance. You will hear more about our international plans in the times to come."

An accounting graduate from King Faisal University, Saudi Arabia who went on to do a general management programme at Harvard Business School, Al-Rumayyan is the Governor of Public Investment Fund (PIF) since May 2019. He was appointed chairman of the board of Saudi Aramco in September 2019.

Al-Rumayyan's experience encompasses over 25 years working in some of Saudi Arabia's key financial institutions.

He began his career at the Saudi Hollandi Bank, where he occupied key positions in various departments. He is a member of the Council of Economic and Development Affairs, and also serves as an advisor to the General Secretariat of the Council of Ministers, the Chairman of the Decision Support Center, and a board member of the Saudi Industrial Development Fund.

Ambani had in August 2019 announced talks for the sale of a 20 per cent stake in the oil-to-chemicals (O2C) business, which comprises its twin oil refineries at Jamnagar in Gujarat and petrochemical assets to the world's largest oil exporter.

The deal was to conclude by March 2020 but has been delayed.

Talks have revived this year and the two are reportedly discussing a cash and share deal - Aramco paying for the stake with its shares initially and then staggered cash payments over several years.

Besides refineries and petrochemical plants, the O2C business also comprises a 51 per cent stake in the fuel retailing business. It, however, does not include the upstream oil and gas producing assets such as the flagging KG-D6 block in the Bay of Bengal.

RIL had in 2019 put $75 billion as the value of the O2C business after signing a non-binding letter of intent with Saudi Aramco.

The firm had recently announced carving out the O2C business as a separate subsidiary to support strategic partnerships and new investors in order to accelerate its new energy and material plans.

Digital business is already held by a subsidiary Jio Platforms and Reliance Retail holds the offline and online retail business.

Aramco buying 20 per cent in O2C business would allow Reliance to build financial muscle, as it carves out a space for itself in highly competitive omnichannel retail.

With a stake, Aramco would have a share in one of the world's best refineries and largest integrated petrochemical complex. It has access to one of the fastest-growing markets, a ready-made market for 5 lakh barrels per day of its Arabian crude and offering a potentially bigger downstream role in the future.

Besides Ambani, the RIL board has his wife Nita and cousins Hital and Nikhil Meswani. Business heads PMS Prasad and PK Kapil too are on the board.

Independent directors include eminent scientist Raghunath A Mashelkar, 78; Adil Zainulbhai, 67; Dipak C Jain, 64; former finance secretary Raminder Singh Gujral, 68; Shumeet Banerji, 59; former SBI chairperson Arundhati Bhattacharya, 63; and former CVC K V Chowdary, 66.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)