In a major setback for Fortis Healthcare, the Supreme Court (SC) on Friday ordered that the status quo be maintained with respect to the stake sale of the beleaguered hospital chain to Malaysia’s IHH Healthcare Berhad.

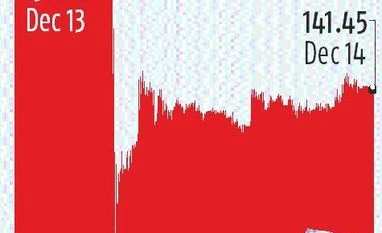

Hearing a contempt petition moved by Daiichi Sankyo, the apex court issued notices to Indiabulls Housing Finance, Indiabulls Ventures, Oscar Investments, and RHC Holding. Following the news, shares of Fortis fell as much as 14 per cent, but partially recovered later to close at Rs 141.5 apiece, down 6.7 per cent.

Sources in Fortis, however, indicated that the hospital major, now backed by IHH, might move a review petition in the SC soon. The court reopens on January 2 after the winter break. The Fortis-IHH deal, as a result, will be on hold till the matter comes up before the court.

Sources said IHH had not filed a caveat in the SC in the ongoing tussle. At the time the deal was announced, IHH’s Group CEO Tan See Leng had told Business Standard that they had taken a “calculated risk”.

“We know there is a risk. Once we get into the asset, there will be more things we will uncover. But given the length of time and discipline we have put for due diligence, we mitigated a large part of it. I think, with the new board in place, transparency in the bid process, and disclosures that have been put… we have taken a calculated risk. We are confident of turning around the asset,” Tan had said.

Sources claimed that there was no backing out for the Malaysian firm at the moment. However, Fortis and IHH were taking legal counsel.

Senior management from IHH have been visiting India regularly to chart out future plans for the hospital chain they recently acquired. Earlier this week, Tan and his senior team members were in India.

Moreover, IHH was set to launch its mandatory open offer for a 26 per cent stake in Fortis Healthcare at Rs 170 apiece on December 18. The open offer would now be delayed as the court has ordered the status quo on the deal.

As part of the deal to acquire a controlling stake in Fortis Healthcare, IHH was to first infuse Rs 40 billion through preferential allotment at Rs 170 apiece (for a 31 per cent stake) and follow it up with a mandatory open offer for another 26 per cent at the same share price.

An email sent to Fortis Healthcare and IHH remained unanswered till the time of going to press.

In a notification to the stock exchanges on Friday, Fortis said, “We would like to inform that the company was not a party to these judicial proceedings. We are awaiting the receipt of this order, and upon consideration of the same, we shall respond appropriately, in accordance with applicable law.”

In its contempt plea before the court, Daiichi alleged that Indiabulls, Oscar Investments, and RHC Holding created fresh encumbrances with respect to Fortis Healthcare on 1.2 million shares held by Fortis Healthcare Holdings despite the court’s orders against it.

The fresh encumbrances on shares could not have been done even by the way of pre-signed instruction slips, Daiichi said. Indiabulls, Oscar Investments, and RHC Holding used the route to create the fresh encumbrances, thereby causing a significant reduction in the shareholding of Fortis Healthcare Holdings in Fortis Healthcare, Daiichi said.

The apex court had on February 15 allowed banks and financial institutions to sell shares of Fortis Healthcare pledged with them on or before August 31 by the Singh brothers. The court had, however, said there could be no fresh encumbrances created by the Singh brothers and others and had directed maintenance of the status quo.

Daiichi has alleged that the Singh brothers, who own Oscar Investments and RHC Holding, and Indiabulls had created fresh encumbrances for nearly 1.7 million of the total 2.3 million shares that were left after the top court’s order. Of these, while Indiabulls created encumbrances for 1.2 million shares, the rest had either been created by the Singh brothers or other third parties, Daiichi said in its petition.

Earlier this year, the Delhi High Court had allowed the Singh brothers to sell Fortis Healthcare shares based on their submission that the disclosed value of their unencumbered assets would remain unaffected. The value of unencumbered Fortis Healthcare assets held by Fortis Healthcare Holdings is estimated to be Rs 25 billion.

Fortis and IHH are now on a sticky wicket as the Malaysian healthcare major has already infused Rs 40 billion in Fortis Healthcare, after the deal got the nod of the competition watchdog. It is, in fact, planning to infuse an additional Rs 20 billion to meet fund requirements of the Fortis group. IHH has already launched a mandatory open offer for 26 per cent shares of Fortis Malar, a step-down subsidiary of Fortis Healthcare.

Meanwhile, with IHH in the driver’s seat, analysts were expecting India’s second-largest hospital network, Fortis Healthcare, to be on the road to recovery soon. They expected the occupancy rate to stabilise at around 70 per cent, which would fuel a mid-teens margin by the year-end.

“The recovery is going to take three more quarters. Going into 2019-20, things will start looking good on a sustainable basis,” Edelweiss Securities had said in a recent note.

Analysts pointed out that the average revenue per occupied bed (ARPOB), a key operating metric for hospitals, has remained more or less stable in the past few quarters. In Q2 this year, it grew to Rs 14.9 million compared to Rs 14.6 million in the corresponding quarter last year.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)