SoftBank had led a $210-million investment in Ola and put in $627 million in Snapdeal in October 2014. It had also made follow-on investments in both firms. The news of markdowns in the value of Ola and Snapdeal comes at a time when both companies are in talks with investors to raise fresh funds to take on deep-pocketed competition.

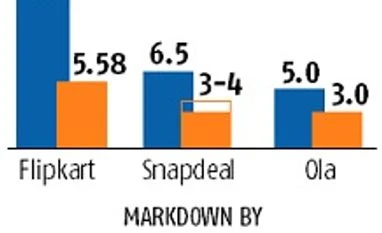

Snapdeal is said to be in talks with SoftBank to raise fresh funds at a valuation between $3-4 billion, down from its peak valuation of $6.5 billion. Similarly, Ola is on the market to raise fresh funds at a valuation of $3 billion, down from a peak valuation of $5 billion.

In November, SoftBank had reported a loss of 58,140 million yen through depreciation in value of its shareholding in Ola and Snapdeal for the six months that ended September. Of that figure, 29,622 million yen was contributed because of the fluctuation in yen.

Removing the changes in the value of SoftBank’s shareholding because of losses or gains from currency fluctuation, the investor marked down the value of its combined shares in Ola and Snapdeal by 26,896 million yen ($230 million) in the three months ended December 31.

Despite the eroding value of its two largest investments in the country, SoftBank Chairman Masayoshi Son continues to be bullish on investing here. In December, Son said SoftBank would surpass its $10-billion commitment in the country, having already invested $2 billion here.

“The 21st century belongs to India, since the demographics are on its side when it comes to being a superpower,” Son said last year. “There are over 800 million young people in the country, who are smart.”

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)