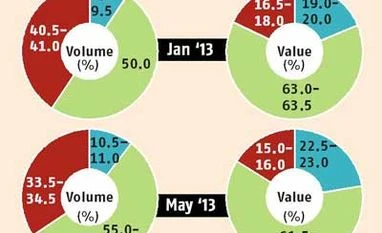

According to retail audits by independent agencies (which track towns with a population over 50,000), as well as industry estimates, Apple Inc’s share of the tablet market (screen sizes above seven inches) has gone up in value terms from 19-20 per cent in January to 23 per cent in May, for which figures are available. During this period, its volume share has been inching up between nine and 11 per cent. Apple India did not reply to a query on the market share figures.

Of course, Samsung still reigns supreme, though its value share of the market fell marginally from over 63 per cent in January to 62 per cent in May. The others with some presence include Micromax, the largest Indian player, apart from HCL and Karbonn.

The tablet is small but is growing fast. It is estimated over 1.5 million tablets were sold in the country last year. This year, the number is expected to more than double to 3.5 million. IDC estimates (this does not include tablets like Akash which have been pushed by the government) are more ambitious: it expects six million tablets to be sold this year.

Opinion is, however, divided as to the speed of the growth of the market. “Tablet market is doubling every year and offers a lot of opportunities. Samsung is not just targeting to expand the market share but to actually grow the market. Language support on tablets will further help in growing the category. Samsung’s value market share is 60%,” said a Samsung spokesperson.

Others say that the ambitious targets have to be adjusted downwards. Says S N Rai, chairman of Lava Mobiles which also sells tablets: “With the slowdown in the economy, the market is not expected to go beyond 3.5 million. Earlier, we thought it would hit six million the way demand was growing.” However, Rahul Sharma, co-founder of Micromax has a different take: “We are expecting our tablet sales to double this financial year, and the maximum growth will be in the sub Rs 20,000 category for us.”

In contrast to the smartphone market, which is expected to grow by only 20 per cent, tabs are surely on the fast track. The growth in the tablet market has been propelled by the mini range, primarily constituted by screen sizes between seven inch and eight inch, which currently constitutes for 88 per cent of this segment’s market. It is here that Apple has become a significant player. It sells its mini (with Wi-fi and cellular) at an entry price of Rs 29,900, taking on Samsung’s Galaxy Note (16 GB) at Rs 30,990 but offers a slightly larger 8 inch screen.

But unlike Samsung, Apple has no product at the sub Rs 20,000 level. Samsung has four products under this range which includes a range of Wi-fi 7 inch tablets at even below Rs 13,000 and that generates large volumes.

The two are also slugging it out in the 9.7 to 10.1 inch market which constitutes for only 11 per cent of the total tab market. Apple, however, is the price leader here with an entry price of Rs 32,900 for a 16 GB product (iPad2 that works on both Wi-fi and 3G networks) compared to Rs 38,250 (Galaxy Note 800 which works on both Wi-fi and 3G networks) offered by Samsung but for a slightly larger screen of 10.1 inches. However, the only Wi-fi version of the Apple iPad 2 is priced at Rs 24,500.

Most companies expect that the tablet market will get a major fillip next year once Reliance Jio launches 4G services across the country to take on Airtel. With Reliance expected to enter 100 cities, most of the players are already experimenting with 4G powered tablets. Jaina Marketing, which owns Karbonn brands, has already developed a 4G tablet, which will be priced over Rs 20,000.

)