Tata Sons said in a strongly worded letter on Thursday that the group's overall indebtedness rose exponentially under former chairman Cyrus Mistry.

According to Tata Sons, the group’s total debt increased by Rs 69,877 crore to Rs 225,740 crore between 2012-13 and 2015-16. But the net debt-to-equity ratio also declined sharply in the same period.

Mistry became chairman of Tata Sons on December 28, 2012.

The letter attributed the indebtedness to large capital expenditure by group companies during the period. "Despite huge investments by companies, the returns are not visible in increased profits," the letter said.

The combined gross debt of the Tata group’s other listed companies did reach a new high during Mistry’s tenure, but so did other financial parameters. This resulted in a decline in the group indebtedness (see chart).

More From This Section

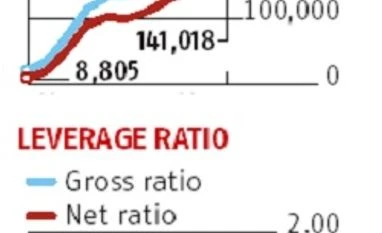

The combined average annual gross debt of the group's 18 listed companies rose 50% from Rs 1.57 lakh crore in 2011-12 to Rs 2.36 lakh crore in 2015-16. During the same period, their combined net worth, or equity, climbed 51% from Rs 1.27 lakh crore in 2011-12 to Rs 1.92 lakh crore in 2015-16. The group’s leverage ratio declined marginally from 1.24 in 2011-12 to 1.23 in 2015-16.

Nearly 72% of the rise in incremental debt during the period was accounted for by Tata Steel at Rs 26,300 crore and Tata Motors at Rs 23,300 crore. They are followed by Tata Power and Tata Teleservices (Maharashtra), accounting for around 9% each. Nine of the group companies were debt-free on a net basis during the period. These include Tata Consultancy Services, Titan and Voltas.

The analysis is based on the financials of the Tata group’s 18 listed companies, excluding their listed subsidiaries. The list includes associates of listed companies where other listed group companies own less than a 51% stake but Tata Sons has no stake.

Accounting for cash and equivalents, there has been a major improvement in the group’s indebtedness during Mistry’s tenure. The group’s net debt declined in absolute terms in 2015-16 for the first time in five years.

Net of cash and equivalents, the group’s net debt-to-equity ratio, or leverage ratio, declined to a nine-year low of 0.73 during 2015-16 from 0.86 in 2011-12. The group’s net debt-to-equity ratio had hit a record high of 1.28 in 2009-10.

The Tata group companies were sitting on cash and equivalents worth Rs 1.02 lakh crore at the end of 2015-16, up from Rs 56,700 crore at the end of 2011-12. Nearly half of this cash pile is accounted for by Tata Motors with TCS contributing another 28%.

Excluding these two companies, the group's net debt-to-equity ratio worsens to 2.25 in 2015-16 from 1.12 in 2011-12. This is largely due to a continuous decline in Tata Steel's net worth on account of losses in its European operations.

READ OUR FULL COVERAGE

READ OUR FULL COVERAGE

)