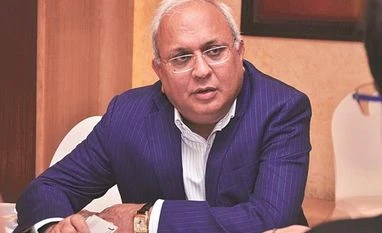

The primary and secondary markets in India have been buzzing with activity for the past few months. Samir Arora, founder and fund manager, Helios Capital, tells Puneet Wadhwa in an interview that there is no strong reason to believe that the generally strong equity markets will largely disappoint in the coming few years. Edited excerpts:

Equities, commodities, inflation, and global debt levels — everything is on an upswing. Do you think this will end badly for the global financial markets a few years from now?

Well since stocks and commodities have 7-10 year cycles, it is true that one day this (rally) will end with a big fall. As of now, there is no strong reason to believe that the generally strong equity markets will not continue to do well (although obviously not as well as the past year) for a few more years.

How do you see the second half of CY2021 playing out for the Indian equity markets?

I see the second half of 2021 as more of a consolidation period at the index level. We buy individual stocks and so are always looking out for bottom-up ideas with a view to outperforming the market. The third wave of Covid will always be a risk, although examples of other countries are indicating that its effects on the economy and markets may be limited. A surprise may be a weaker-than-expected recovery, if it turns out that the initial demand spurt we have seen — or may see for a few months — is more of pent-up demand.

What’s your views on mid-, small-caps?

In general, it is time to reduce weight in mid- and small-cap stocks as their valuations are more or less in line with bigger, better companies. We have nearly 70 per cent of our portfolio in large-cap companies and the balance in mid/small companies. On the margin, we will add to larger-cap companies.

How shall foreign investors interpret the investment climate in India against the backdrop of the government’s recent stand on retrospective taxation?

India is receiving strong inflows from all types of foreign investors already, and the removal of any issue that specifically bugs any class of investors helps everyone. That’s because these things work in virtuous and reinforcing cycles, where higher foreign direct investment (FDI) motivates higher private equity (PE) flows and higher foreign portfolio flows (FPI) flows, and vice versa.

Can foreign funds look at India as an alternative destination, given the developments in China, or will pricey valuation here be a deterrent?

FPIs and FDI, and even PE capital were already quite bullish on India for the past few years. In this context, it is logical to project that as foreign investors get upset with China (and there are many reasons for them to get upset), they may increase their allocation to India. India’s weighting in equity benchmarks is about one-fourth of China. Therefore, even a slight pull out of China or a reallocation to the rest of emerging markets will be a meaningful increase for India. Also, vibrant equity markets and PE exits via IPOs will attract higher flows and confidence from PE investors.

Growth, value or momentum — what should investors chase now?

Why do we have to choose — our job is to outperform markets consistently and not only in phases where the current style of the market matches our investment style. Each company has to be evaluated on its merit, and our portfolio may include India’s largest state-owned bank that offers extreme value, while also holding some other stock(s) that offer very high growth and also have high valuations.

We believe (we don’t believe, we know) that a large number of companies do well in any year or period and we owe 30-35 stocks that have been bought on a basis that makes sense to us. For some stocks, their extreme value makes sense and for some may be their high growth makes sense. This model has worked very well for us for over 25 years and helped us outperform the benchmarks and peers with reasonable consistency.

What are the weak links that can dent sentiment in the BFSI sector?

We are most bullish on all aspects of the financial sector — private sector banks, even one state-owned bank, insurance, mortgage finance, broking, wealth management, gold finance, etc. Unlike the consumer sector, valuations in BFSI have not increased a lot and returns over the past many years have come via earnings growth, rather than re-rating of companies. This gives these companies valuation comfort.

Did you pick up Zomato in the initial public offering (IPO)?

We were willing to buy Zomato shares on listing but not at the price at which it ultimately listed. We will watch the sector and other companies in general tech to see if other companies generate interest in our analysts and me.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)