For most, $16 billion might seem like a huge amount, but for Bentonville-based Walmart Inc it is a small price to pay as it looks to take on global e-commerce giant Amazon, which is now making rapid moves in offline retail.

For the money it is spending on acquiring a 77 per cent stake in Bengaluru-based online marketplace firm Flipkart, Walmart hopes to finally prop up a formidable opponent against the Jeff Bezos-run juggernaut that is out to create a one-stop solution for possibly every problem in the world.

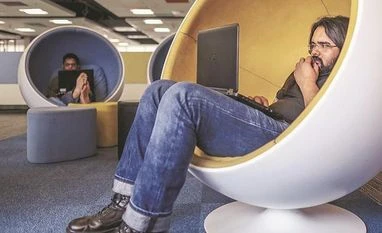

In an investor call on Wednesday, Walmart’s senior management sitting in the plush boardroom of Flipkart’s brand new headquarters in Bengaluru tried to quell fears of analysts about the deal. The company not only hopes that Flipkart will help it understand the e-commerce business better and take on Amazon, not only in India but globally as well, it could also be an important link its business-to-customer (B2C) offline retail dreams in India.

Over the next few months, according to people who were part of the team that finalised the merger, Walmart will be sending its army of executives to India to understand the market as well as how e-commerce functions in the country.

It will also be bringing in a host of new products and private labels to expand Flipkart’s online marketplace capabilities. “Walmart will finally be able to understand how to run a business in a mass market like India and will take these learnings abroad. It will be able to tap into the 54-million active user base in the country,” said a senior executive from a firm that helped Walmart bag the Flipkart deal.

In an investor call, Doug McMillon, president and chief executive officer of Walmart, made it clear that Flipkart, which has done well over the last few quarters, would help it learn about the ecosystem. “We want to get the learnings from Flipkart and take it to other parts of the world,” he said.

Walmart has listed benefits such as Flipkart’s push towards artificial intelligence (AI), vast user data and customer profiles, and even its payments platform PhonePe as the main reason for this acquisition. Industry insiders believe that Walmart will be inheriting a wholesome ever-expanding ecosystem of e-commerce and services which will rival that of Amazon. This is what it plans to take abroad.

“Flipkart is a local business built from ground up. It understands its customers. It has a strong apparel segment, it has PhonePe and together it is a unique combination,” said Judith McKenna, President and CEO, Walmart International, and Marc Lore in the call.

Also with more than 35,000 engineers, Flipkart is the best source for research and development that would help Walmart find solutions to its retail problems in India and abroad.

Walmart has finally made the first move into its dream of selling online as well as offline in India. According to sources close to the company, Walmart wants to make Flipkart its gateway for omni-channel growth in India. While it is still a far from its dream of doing multi-brand in retail, analysts believe that with the government looking for foreign direct investment (FDI), it might be allowed in the near future. “With Flipkart, it will create that online platform for its omni-channel approach. Whenever it finally opens its B2C stores, Flipkart will be its biggest ally,” said a senior executive of a major retail firm.

Walmart has made it clear that it will be supporting agri-business as well as small and medium enterprises in India. The company plans to take these ideas forward and get in touch with a host of agri-based companies as well as directly work with farmers to sell on Flipkart. The company is also planning to promote SMEs on the platform.

Not too excited about the merger, analysts wanted to understand how Walmart would factor in Flipkart’s operational losses. While saying that they did not want to get into ‘historical financials’ Walmart’s senior management indicated that some tough decisions had to be taken, but in the long run these risks would pay off.

According to market analysts, Flipkart has accumulated over $2 billion dollar in losses owing to the long-running discounting feud it has fought with Amazon. Analysts have also been left wondering why $16 billion was not invested in Walmart’s home market to solidify its position in the US. Walmart’s chief financial officer Brett Biggs said that the US was obviously very important for the company, and it would do everything required to protect the core.

Walmart’s India story

2007: Joint venture between Bharti Enterprises and Walmart to build and operate cash and carry superstores in India under the name Best Price Modern Wholesale

2009: Walmart India Private Limited a wholly owned subsidiary of Walmart Inc. opened the first store was in Amritsar

Walmart India starts operations of 20 Best Price Modern Wholesale stores in 8 states across India.

2012: Govt decides to open India to foreign multi-brand retailers. Plans, however, face backlash

2013: Walmart terminates its joint venture with Bharti Enterprises.

Company names Krish Iyer as CEO for India

2014: Walmart announces plans to open 50 cash and carry stores

Launches its B2B e-commerce platform for members in Lucknow and Hyderabad

2015: Opens store number 21 in Agra.

2017: Announces plans to launch its cash and carry business in Mumbai

Begins talks for a buying stake in Flipkart

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)