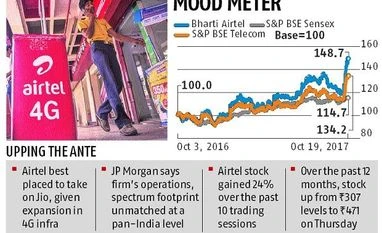

The Bharti Airtel stock has gained 24 per cent over the past 10 trading sessions, despite the competitive pressure and regulatory headwinds in the telecom segment. And not just in the recent past, over the past 12 months, too, the stock is up from Rs 307 levels to Rs 471 at Thursday’s close, even while Reliance Jio entered the sector last September and offered free services till recently.

While the pricing pressure continues and the cut in the interconnect usage charges from October 1 would impact Airtel’s revenues and operating profit, analysts believe that the firm is best placed among existing players to withstand competition from Jio in terms of subscriber base, spectrum, technology, product offerings and balance sheet. There have been a number of triggers this month alone, sparking optimism about the Sunil Mittal-led telco stock’s prospects.

The company has been improving its position, by acquisitions and shoring up its 4G network, as well as by strengthening infrastructure and reach. The recent acquisition of the consumer mobile services business of the Tatas would help add 35.4 million active customers and five per cent revenue market share to Airtel’s 271-million base and 32.5 per cent revenue market share.

Combined with the recent acquisition of Telenor and expectations of some more additions in the run-up to the Vodafone-Idea merger, analysts expect the company’s revenue market share to hit the 40 per cent mark. More importantly, with the Tata acquisition, the company gets access to 178.5 MHz of spectrum — of which about 71 MHz is liberalised spectrum —at a discounted price, even after considering the unpaid spectrum liability.

Analysts at Bank of America Merrill Lynch see the transaction generating synergies (both at operating and capital expenditure fronts) and contributing to positive operating profits within a few quarters of completion. The Tata transaction follows an ongoing strategy of acquiring spectrum from smaller players given its deals with Telenor, Aircel, Qualcomm, Videocon and Augere Wireless.

The management at Airtel believes the group would spring a surprise with a sharp recovery. Highly-placed sources in the company said Airtel would not leave the top slot to newcomer Jio. "We will win the market much stronger and faster than people can imagine,’’ a top executive said.

In fact, conversations with several officials in the company indicated that Airtel’s expectation on revenue market share is in sync with analysts. The telco’s internal calculation is it would move up to 36 per cent and then to 40 per cent in not-too-distant future. A source said Airtel could possibly gain from the Vodafone-Idea merger, as many subscribers would look to port to another network. “Even if Jio takes away some of the Vodafone-Idea subscribers, we will remain market leaders for years,” the source said.

Though in the corner rooms of the group there are talks of Jio being a formidable rival with deep pockets and a clear strategy to win the market, Mittal and his A team look prepared for the long haul. Tariffs may not go up significantly in the season of deep discounts, though there’s hope that the average revenue per user would rise over the coming months as subscribers step up their data consumption and freebies dry up.

Earlier this month, the company indicated it would invest a large part of its FY18 spending of Rs 20,000 crore on expanding the 4G infrastructure. Analysts, however, say it would take at least a year for the incumbents to catch up with Jio, given the head start the Mukesh Ambani-led company has with 4G network (and investments in fibre assets, towers) across the country from Day 1 of operations. To match Jio, especially in the entry-level market, Airtel recently tied up with smartphone maker Karbonn to launch the Karbonn A40, a 4G-enabled feature phone, in the market for an effective price of Rs 1,399.

Among the incumbents, analysts at JP Morgan say, Airtel’s operations and spectrum footprint is unmatched at a pan-India level. It is an early 4G mover leading the 4G spectrum and 4G network roll-outs, far ahead of incumbent peers such as Idea and Vodafone (taken pre-consolidated). As India leapfrogs from 2G to 4G and as 3G withers away, Airtel and Jio may emerge outsized winners in the 4G wireless industry, they add.

It is not surprising then that Airtel has been gaining on revenue and subscriber market share, while smaller operators as well as Idea and Vodafone have been ceding share. Airtel’s revenue market share has continued to expand, with a 140-basis point gain over the past 12 months. Till August, while Airtel added 2.4 million subscribers, Idea and Vodafone lost 5.2 million and 2.8 million subscribers, respectively. Smaller operators lost 47 million customers since Jio’s launch and, barring BSNL/MTNL, they had a revenue market share of 15.7 per cent in the June quarter, which will be up for grabs given the nature of competitive intensity, consolidation and financial leverage.

Airtel, on the other hand, with a net debt to operating profit level of less than three times (on an annualised basis for FY18) and scope for further reduction as it monetises some of its tower investments such as those in Bharti Infratel, has enough ammunition to fight Jio.

The consolidation in the African market should also help the company strengthen its position. Airtel’s latest merger with Millicom will make the combined entity Ghana’s second-largest mobile operator. The consolidation and scaling down of Africa operations has helped improve its operating profit margins from 23 per cent in the September 2016 quarter to an estimated 29 per cent in the September 2017 quarter, in the Africa business. In fact, Airtel’s marginal revenue growth in the September quarter on a consolidated basis could be led by the Africa operations, where revenue growth is exhibiting a positive trend. The Africa business, headed by Raghunath Mandava, is learnt to be looking at some more rationalisation.

Although statements by Airtel have often claimed that the “predatory pricing” by Jio has hurt the industry in a big way, many executives indicated that the sector has seen much worse. Still, betting big on telecom, Airtel is waiting for a major comeback.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)