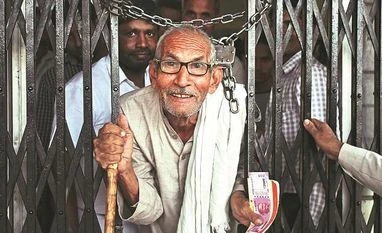

The Reserve Bank of India (RBI) has asked banks to provide customised basic services to senior citizens of more than 70 years of age and differently-abled persons at their doorstep. This initiative should be implemented by December 31, 2017, as per the RBI order.

Senior citizens, along with the visually-impaired, would get basic services like pick-up and delivery of cash, chequebooks and demand drafts, submission of know your customer (KYC) documents and life certificates at their homes.

In a circular to banks, RBI said that "it has been observed that there are occasions when banks discourage senior citizens from availing banking facilities in branches".

"Notwithstanding the need to push digital transactions and use of ATMs, it is imperative to be sensitive to the requirements of senior citizens and differently-abled persons," the circular said.

With an initiative to address the issue, RBI has directed banks to set up dedicated counters for the implementation of this programme.

However, the charges are not being mentioned yet.

The RBI also issued directions on other problems usually faced by senior citizens.

From now on, pensioners can submit physical life certificate form at any branch of the pension-paying bank.

Banks must ensure that all the certificates submitted by pensioners at any branch and not just the pension-paying branch should be uploaded to their core banking systems (CBS).

Further, a minimum of 25 cheque leaves every year for a savings bank account should be provided free of charge, the RBI directed.

No bank should insist on the physical presence of any customer, including senior citizens and differently-abled persons, for availing of chequebooks.

According to the circular issued by the RBI, a fully KYC-compliant account should automatically be converted into a 'senior citizen account' based on the date of birth available in the bank's records.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)