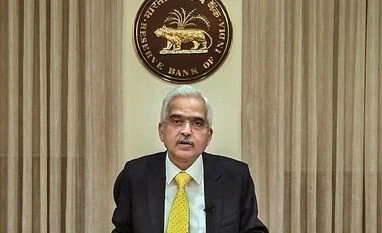

Reserve Bank Governor Shaktikanta Das on Wednesday awarded the 'Governor of the Year' award for 2023 by the international publication Central Banking for captaining the financial markets through the turbulent periods of the pandemic and the crippling impact of the Ukraine war.

Former governor Raghuram Rajan was the first to be conferred the title back in 2015 from the country.

Awarding the 66-year-old Das, who is into his second term at the Mint Road, the publication said the governor helped manoeuvre the ship as it faced multiple obstacles since his appointment in December 2019, the Covid-19 pandemic and the Russia-Ukraine war being the two major tests.

An economy as complex as India's will likely never be free from challenges but, as Das faces up to the remainder of his second term, he can take pride in major achievements so far," the award citation said.

Das has captained critical reforms, overseen world-leading payments innovation and steered the country through difficult times with a steady hand and well-crafted turn of phrase, it added.

The Central Banking Publications is a financial publisher specialising in public policy and financial markets, with an emphasis on central banks, and international financial institutions.

Also Read

Addressing the award ceremony, Das said, "A war effort has to be mounted, and is being mounted, to combat the virus, involving both conventional and unconventional measures in continuous battle-ready mode.

"Life in the time of Covid-19 has been one of unprecedented loss and isolation. Yet, it is worthwhile to remember that tough times never last; only tough people and tough institutions do."

The publication said that Indian economy came through one of the greatest threats it has ever faced with relatively minimal scarring.

All RBI governors face the difficulty of working with governments that have different priorities to the central bank, and most will have to overcome crises during their tenures. But few have had to contend with challenges on the scale that Das has met, it said, adding in the years ahead, Das will have to stand firm against interference and backsliding.

The publication said the RBI, since the turn of the pandemic, has been actively engaged in managing the benchmark lending rate and other levers at its disposal.

To start with, the Monetary Policy Committee, and has since May 2022 jacked up key policy rates by a whopping 250 bps to 6.50 per cent as the panel missed the inflation prints 10 of the 12 months of the year. This also had Das being forced to write to the government explaining why it lost the inflation battle. The letter is yet to be made public.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

)