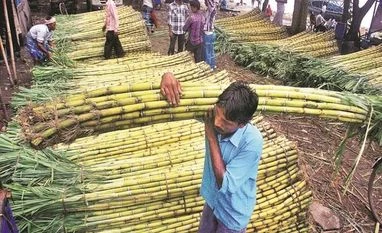

Mills in Uttar Pradesh, the country’s top sugar producer, are likely to start crushing operations from October-end. The projections for the coming season indicate record domestic sugar opening stock of 14.5 million tonnes (MT).

While Western UP units would start operating after Diwali in the last week of October, the sugar mills in Central and Eastern UP have been asked to start by the end of first and second weeks of November, respectively.

The Yogi Adityanath-led government has also announced sugarcane supply quota policy for 2019-20. The policy fixes supply quota of individual farmers, segregating them as marginal, small and regular agriculturists, on the basis of annual cane survey to ascertain the total number of cane farmers, estimated acreage and likely production.

The sugarcane department said it had effected some amendments for the benefit of bona fide farmers and to weed out ‘sugarcane mafia’ and unscrupulous complicity of government and mill officials.

“The sugarcane survey has been completed and mills are likely to start crushing after Diwali. By the middle of November, we expect all mills to begin their operations,” UP sugarcane principal secretary Sanjay Bhoosreddy told Business Standard.

Meanwhile, the private mills in UP are still baulked down by high arrears pertaining to the 2018-19 season. Total arrears are to the tune of Rs 8,000 crore, the bulk of which are due on private mills, which collectively number 94 of the total 119 mills in the state.

Recently, the state had set the deadline of August 31 for mills to settle their outstanding. Against total cane payables of Rs 33,047 crore, UP mills had so far paid about Rs 25,000 crore to farmers, thus leaving nearly 25% or about Rs 8,000 crore in arrears for 2018-19.

The government had warned defaulting mills of filing of cases under Section 3/7 of Essential Commodities Act (ESA) 1955 and issuance of recovery certificates (RC), which authorises the district administration to seize plant and stock for auctioning.

Among top defaulters are Bajaj Hindusthan group, Simbhaoli, Modi Dhampur etc. “The arrears are unlikely to subside anytime soon, since defaulting mills in the state do not have financial resources to pare their outstanding position. Besides, they have not been provided with any government scheme to help them settle their payment liabilities,” a Simbhaoli group official said.

He further claimed the soft loan scheme had only benefited the big groups, who were already well-heeled so far as their financial standing to repay farmers was concerned.

In 2018-19, UP sugar output stood at about 11.8 MT compared to a little over 12 MT in 2017-18.

In 2019-20, India’s sugar output is projected to dip by nearly 14% to about 28 MT from 33 MT in the current sugar season 2018-19. Indian Sugar Mills Association (ISMA) had earlier attributed its preliminary projections to poor rainfall and low water availability in major cane growing states of Maharashtra, Karnataka and Tamil Nadu.

However, sugar opening stock is expected at record high of 14.5 MT, almost three times ‘normative requirement’ of 5 MT in carryover stock. Since, annual sugar requirement is around 2.65 MT, there would still be surplus stock in next season with ISMA stressing for allowing sugar exports to insulate sugar companies from prospective losses arising out of inventory costs.

“The silver lining is that global sugar market is likely to have a deficit of 4 MT, which would provide an opportunity to Indian companies. However, the Centre should announce sugar export policy early, so that millers get time to capitalise on the favourable matrix,” ISMA director general Abinash Verma had earlier underlined.

The Association had pegged domestic cane acreage at 4.93 million hectares (MH) in 2019-20, roughly 11% lower compared to 5.50 MH last year. Meanwhile, UP is estimated to have cane area of 2.36 MH, 2% lower than 2.41 MH in 2018-19. However, the state is projected to record better yield per hectare due to high yielding varieties.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)