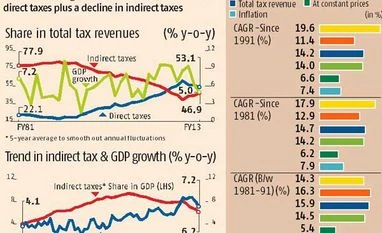

At the peak in 1988, the government collected nearly a tenth of GDP as indirect taxes. The ratio declined to 5.6 per cent in FY13. Conversely, the recent deceleration in economic growth has been accompanied by an increase in indirect taxes and decline in the share of direct taxes in the government’s total tax kitty (see chart).

In the past four years, the share of indirect tax in the central government’s total tax kitty rose from 39.2 per cent in FY10 to 46.9 per cent in FY13. And, there has been a corresponding fall in the contribution from direct taxes. India’s GDP growth during the period declined from 8.6 per cent in FY10 to five per cent last financial year, according to Reserve Bank of India data.

Modi had said the tax system needs to be reformed as it has become a burden for the common man. The BJP has been studying a proposal to replace the tax system with a uniform banking transaction tax.

Since 1991, the GDP at current prices (including inflation) grew at a compounded annual rate (CAGR) of 14 per cent, against 11.4 per cent CAGR growth in indirect tax collection during the period. Direct tax collection in the period expanded at 19.6 per cent CAGR, allowing the Union government to raise the tax to GDP ratio without hurting growth.

Adjusted for inflation, GDP grew at a CAGR of 6.6 per cent since 1991, much faster than the four per cent buoyancy in indirect taxes during the period. Direct tax collection expanded at a CAGR of 12.3 per cent after 1991. Indirect taxes are also inflationary in nature. For example, from 1981 to 1991, when indirect tax collection (16.3 per cent CAGR) grew faster than direct taxes (14.3 per cent), inflation was much higher than after 1991 (see table).

Economists are not surprised at this inverse link between indirect taxes and economic growth. “Indirect taxes are like an across-the-board consumption tax, that hits the poor more than the rich. As the poor devote a higher share of their incremental income to consumption, a greater share of their income is spent on taxes than the rich whose consumption to income ratio is lower. This lowers overall demand in the economy and economic growth suffers,” says Devendra Pant, chief economist and head, public finance, at India Ratings.

In contrast, direct taxes such as personal income taxes are progressive, with higher earners paying more than those at the lower end of the pyramid. And, a majority escape the tax as their income is below the threshold level where these kick in. Businesses, on the other hand, pay corporate income taxes only if they make profits and enjoy tax breaks for capex in the form of a rebate on depreciation allowances and interest payments. This encourages capital expenditure that helps the economy to grow faster.

Indirect taxes such as excise, Customs, sales and service taxes, on the other hand, have to be paid regardless of a company’s profitability. This hurts during an economic slowdown, when demand is down and customers hunt for bargains. “An efficient tax system aids economic growth, while infirmities in the taxation systems hurts investments and growth,” says Indranil Pan, chief economist at Kotak Mahindra Bank.

Direct taxes, while economically efficient, are tougher and costlier to collect than indirect ones, collected at the point of economic activity — production (excise & service tax), trade (Customs duty) and purchase (sales taxes).

An efficient direct tax administration requires a detailed database on income and expenses of every tax payers, individuals and business, and a network of offices and personnel across the country. “Given the amount of effort and information required to efficiently collect taxes, direct taxes will always have some leakages,” says Pant.

)