Singapore-based Cube Highways is in discussions with Jaypee Infratech and IDBI-led lenders to take over the 165-km Yamuna Expressway Project, sources familiar with the developments said. The Manoj Gaur-promoted company told the Supreme Court on Friday that it had an offer from a company to buy the project, without naming the bidder.

The offer could open up fresh possibilities to Jaypee’s lenders looking to recover loans. Also, it comes as a glimmer of hope for the homebuyers who have been waiting for delivery of apartments.

Cube Highways is a joint venture of private equity firm I Squared Capital and International Finance Corp (IFC), the private investment arm of the World Bank.

On Friday, advocate Anupam Lal Das, appearing for Jaypee Group, told the court it had an offer worth Rs 2,500 crore for the expressway and wanted to hive off the property to another party, a PTI report said. Das said the company had to raise funds to deposit Rs 2,000 crore in the apex court registry to pay its troubled homebuyers. The court would hear the matter on October 23, said the PTI report.

Jaypee had earlier spurned suitors, introduced by its lenders, for its expressway project built at a cost of over Rs 12,000 crore. The earlier offers included those from the private equity arm of IDFC, YES Bank, Deutsche Bank, and Edelweiss Asset Reconstruction Company. Lenders planned on getting the IDFC arm as an investor for about Rs 2,500 crore. "Jaypee, along with some of the lenders, was not keen on the IDFC proposal. Besides, the concession agreement signed with the state government did not allow hiving off of the expressway," a person close to the development said.

As part of the agreement, the Jaypee group was to develop integrated townships on 500 hectares of land each at five places including Noida, Aligarh (Tappal) and Agra. This could not be done as the company ran into debt.

A National Green Tribunal order also prevented work.

The Supreme Court has now asked the company to pay back part of its due to more than 30,000 people who had booked property in its real estate projects along the expressway. The company asked the court to allow handing over the Yamuna Expressway to another developer when asked to deposit Rs 2,000 crore by October 27 to refund homebuyers.

YES Bank, which is a lender to Jaypee Hospital, a subsidiary of Jaypee Infratech, too, wanted to take over the company after it had invoked the promoter guarantee.

Some 40 buyers who had booked flats in Jaypee Wish Town had challenged the insolvency proceedings against Jaypee Infratech. The National Company Law Tribunal had admitted a petition by lenders against the company, which was part of a list of 12 firms against which the Reserve Bank of India had in June asked banks to fast-track insolvency proceedings. Under the Insolvency and Bankruptcy Code, homebuyers cannot be paid back their dues since lenders can stake first claim.

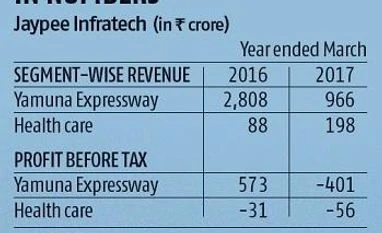

The company had a debt of about Rs 8,100 crore, of which IDBI alone accounts for Rs 3,600 crore. When contacted, Sanjeev Kaushik, managing director, India Infrastructure Finance Company Ltd, said, "Lenders have offers on table and we are hoping for a quick resolution so that there is no erosion of further value." IIFCL has an exposure of Rs 900 crore to Jaypee Infratech.

Cube Highways and Infrastructure was created to takeover stressed highway assets in India. Last year, the company acquired 74 per cent stake in Madhucon Agra Jaipur Expressways and took over the Western UP Tollway.

The six-lane Yamuna Expressway, linking Delhi and Agra, was commissioned in 2012. Investors are looking at upside from toll revenues with the coming up of Lucknow-Agra extension and Lucknow-Balia projects, besides the Noida airport.

While handing over the management of Jaypee Infratech to insolvency resolution professional, the court had restrained its promoters, directors and managing director from travelling abroad without this court's permission.

On Monday, the Supreme Court refused to push further ahead the deadline of October 27 to deposit Rs 2,000 crore. The holding company Jaiprakash Associates had pleaded for extension.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)