The queues were still long outside banks, and automated teller machines (ATMs) continued to turn dry rather fast across cities, as Business Standard took stock of the pan-India scenario more than a week after the late evening announcement by Prime Minister Modi banning Rs 500 and Rs 1,000 currency notes.

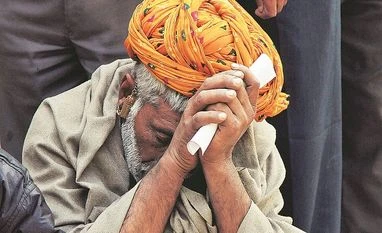

Life hasn’t been the same ever since, as people of all strata joined the queue at all times of the day and night, to stay there for hours and many times returning home without any cash. Even as plastic use has jumped many times and digital wallet has ruled, ATM hopping has become a part of the daily routine during the past one week in search of currency that’s gone missing.

In New Delhi, while ministers, bureaucrats and politicians made noise over the right and wrong of the demonetisation move, logistics at banks remained stretched even on Day 8. The common complaint heard in the city was that only Rs 2,000 notes were being given out by banks, even as customers found it tough to get the big currency changed at any shop. Rs 100 notes remained in short supply, and so did “working’’ ATM machines. “Getting inside bank branches has been a task in itself, leave aside the long wait for money,’’ an account holder said, after two hours of wait.

Indelible ink, which became a part of the currency exchange regime earlier this week, too became a point of contention. In Ahmedabad, for instance, non-availability of indelible ink resulted in chaos in several branches. “While most banks have sought for and have been given additional personnel, many are working till midnight, as the queue refuses to shorten amidst non-availability of the indelible ink,’’ a manager said. Only a few nationalised banks have received the indelible ink, and they are yet to start using it, said a source. According to Maha Gujarat Bank Employees’ Association, as per the Reserve Bank of India (RBI) guideline, indelible ink is to be first used in metros as a pilot.

In Mumbai, ATM networks were only partly functional and bank branches took all the pressure. Improvement was minimal, was how customers reacted when asked whether things were getting better. “Most ATMs remain non-operational for want of cash or awaiting recalibaration to be able to dispense new notes.’’

Also, uncertainty of accessing cash was making people nervous. “There is neither any communication of a clear timetable for recalibration nor any sign of improvement any time soon,’’ another customer said outside a Mumbai bank.Then there were tricks at play. A State Bank of India (SBI) Group official said at ATMs, as a step to avoid getting Rs 2,000 currency notes, people are first withdrawing Rs 1,900 in Rs 100 notes and then putting another request for balance Rs 600, so that they remain within the limit of Rs 2,500 per day withdrawal.

Kolkata was no different. Mohd Zariuddin, a tailor, said he was waiting in a queue for exchanging a note of Rs 500 and four notes of Rs 1,000 each at Strand Road branch of SBI for six hours. The branch happens to be one of the oldest and biggest offices of SBI. Close to 10,000 people have been thronging the branch each day since last week.

Meanwhile, Zariuddin and some others have been successful in rubbing off the ink (meant to mark a person who’s replaced old currency once), to be able to join the queue again if there’s a need. According to RBI directives, the indelible ink can be applied by the cashier or any other official designated by the bank before the notes are given to the customer, so that while the exchange of notes is taking place, a few seconds elapse, which will allow the ink to dry up and prevent removal of the same.

Some of the Bhopal branches saw shorter queues on Thursday, but skirmishes were reported in plenty. “Cash is not sufficient in our branches. Our ATMs are dispensing only Rs 100 notes,” said a banker in Bank of Baroda in Bhopal. But those who were repeatedly visiting branches for currency exchange have disappeared, as bankers were telling them to go for indelible ink first. “Today (Thursday), I am largely attending to my branch customers, as non-customers have disappeared,” another banker in SBI branch said.

To handle queues, innovative steps are being taken by banks. In Ahmedabad, many banks, including private and public sector ones have put up makeshift pandals to beat the heat, and have made arrangements for water outside the branches. A bank manager of a nationalised bank on Ashram Road in Ahmedabad said the chaos was likely to continue through December.

Lucknow seemed to be a tad better, as the panic was subsiding. “Since an individual can only exchange money once, the queues are now shorter, compared to the early days of the announcement of scrapping of currency notes.’’ But, even in Lucknow, ATMs were hardly operational. Also, the new series of Rs 500 notes are still to reach the City of Nawabs.

In Chennai, customers were being turned away by banks, saying they will not exchange the demonetised currency notes and smaller denomination currencies were not available. “I have come down from Chembarambakkam (almost 20 km away from the city) to exchange Rs 3,000 and they denied, saying they don’t have new notes to disburse.’’ A customer who had already lost Rs 800 in daily wages said.

Meanwhile, the situation in banks in Hyderabad worsened on Thursday, with more people thronging the facilities to exchange the demonetised currency notes. “The queues at our facilities have grown longer on Thursday,” State Bank of Hyderabad Managing Director Santanu Mukherjee told Business Standard. “We have been putting all our efforts to provide services to customers and non-customers coming to our branches,” he added.

READ OUR FULL COVERAGE ON THE MODI GOVT'S DEMONETISATION MOVE

Life hasn’t been the same ever since, as people of all strata joined the queue at all times of the day and night, to stay there for hours and many times returning home without any cash. Even as plastic use has jumped many times and digital wallet has ruled, ATM hopping has become a part of the daily routine during the past one week in search of currency that’s gone missing.

In New Delhi, while ministers, bureaucrats and politicians made noise over the right and wrong of the demonetisation move, logistics at banks remained stretched even on Day 8. The common complaint heard in the city was that only Rs 2,000 notes were being given out by banks, even as customers found it tough to get the big currency changed at any shop. Rs 100 notes remained in short supply, and so did “working’’ ATM machines. “Getting inside bank branches has been a task in itself, leave aside the long wait for money,’’ an account holder said, after two hours of wait.

More From This Section

Fights were commonplace over the quantum of cash that one replaced or withdrew, but so were examples of charity where tea and water was being served for free to keep the spirits of the people going.

Indelible ink, which became a part of the currency exchange regime earlier this week, too became a point of contention. In Ahmedabad, for instance, non-availability of indelible ink resulted in chaos in several branches. “While most banks have sought for and have been given additional personnel, many are working till midnight, as the queue refuses to shorten amidst non-availability of the indelible ink,’’ a manager said. Only a few nationalised banks have received the indelible ink, and they are yet to start using it, said a source. According to Maha Gujarat Bank Employees’ Association, as per the Reserve Bank of India (RBI) guideline, indelible ink is to be first used in metros as a pilot.

In Mumbai, ATM networks were only partly functional and bank branches took all the pressure. Improvement was minimal, was how customers reacted when asked whether things were getting better. “Most ATMs remain non-operational for want of cash or awaiting recalibaration to be able to dispense new notes.’’

Also, uncertainty of accessing cash was making people nervous. “There is neither any communication of a clear timetable for recalibration nor any sign of improvement any time soon,’’ another customer said outside a Mumbai bank.Then there were tricks at play. A State Bank of India (SBI) Group official said at ATMs, as a step to avoid getting Rs 2,000 currency notes, people are first withdrawing Rs 1,900 in Rs 100 notes and then putting another request for balance Rs 600, so that they remain within the limit of Rs 2,500 per day withdrawal.

Kolkata was no different. Mohd Zariuddin, a tailor, said he was waiting in a queue for exchanging a note of Rs 500 and four notes of Rs 1,000 each at Strand Road branch of SBI for six hours. The branch happens to be one of the oldest and biggest offices of SBI. Close to 10,000 people have been thronging the branch each day since last week.

Meanwhile, Zariuddin and some others have been successful in rubbing off the ink (meant to mark a person who’s replaced old currency once), to be able to join the queue again if there’s a need. According to RBI directives, the indelible ink can be applied by the cashier or any other official designated by the bank before the notes are given to the customer, so that while the exchange of notes is taking place, a few seconds elapse, which will allow the ink to dry up and prevent removal of the same.

Some of the Bhopal branches saw shorter queues on Thursday, but skirmishes were reported in plenty. “Cash is not sufficient in our branches. Our ATMs are dispensing only Rs 100 notes,” said a banker in Bank of Baroda in Bhopal. But those who were repeatedly visiting branches for currency exchange have disappeared, as bankers were telling them to go for indelible ink first. “Today (Thursday), I am largely attending to my branch customers, as non-customers have disappeared,” another banker in SBI branch said.

To handle queues, innovative steps are being taken by banks. In Ahmedabad, many banks, including private and public sector ones have put up makeshift pandals to beat the heat, and have made arrangements for water outside the branches. A bank manager of a nationalised bank on Ashram Road in Ahmedabad said the chaos was likely to continue through December.

Lucknow seemed to be a tad better, as the panic was subsiding. “Since an individual can only exchange money once, the queues are now shorter, compared to the early days of the announcement of scrapping of currency notes.’’ But, even in Lucknow, ATMs were hardly operational. Also, the new series of Rs 500 notes are still to reach the City of Nawabs.

In Chennai, customers were being turned away by banks, saying they will not exchange the demonetised currency notes and smaller denomination currencies were not available. “I have come down from Chembarambakkam (almost 20 km away from the city) to exchange Rs 3,000 and they denied, saying they don’t have new notes to disburse.’’ A customer who had already lost Rs 800 in daily wages said.

Meanwhile, the situation in banks in Hyderabad worsened on Thursday, with more people thronging the facilities to exchange the demonetised currency notes. “The queues at our facilities have grown longer on Thursday,” State Bank of Hyderabad Managing Director Santanu Mukherjee told Business Standard. “We have been putting all our efforts to provide services to customers and non-customers coming to our branches,” he added.

READ OUR FULL COVERAGE ON THE MODI GOVT'S DEMONETISATION MOVE

)