If data on cash deposits made between November 9 and December 30, 2016, the demonetisation period, is anything to go by, the exercise may well succeed in boosting the tax base.

A staggering 12.5 per cent of the cash deposited by December 30 – when the deadline for depositing banned notes expired – was by those who had a PAN number but had not filed income tax returns in previous years.

Even if a fraction of these do file their returns for 2016-17, it will boost the number of tax returns filed in the current financial year. This analysis carried out by the income tax department is based on only reported cash transactions (not all cash transactions) and excludes accounts without valid PANs.

One of the intended benefits of demonetisation was to widen and deepen the tax base.

But it’s difficult to arrive at precise estimates of just how many new tax payers are likely to have been brought into the tax net and what is the extent of the gains to tax collections.

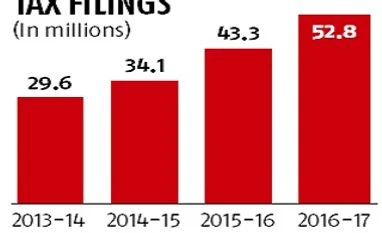

Recent reports suggest that more than 9 million new tax payers have been added due to demonetisation. The number of tax filings rose to 52.86 million in 2016-17, up from 43.34 million in 2015-16, representing an increase of a little more than 9.5 million.

But a closer look at the monthly e-tax filings data published by the income tax department disclose that over 60 per cent of these additional returns, or roughly 5 million, were filed by October 2016 – well before demonetisation was announced.

The rest of these, or roughly 4.49 million, were filed between November and March 2017. By comparison, the increase over the same period in the previous financial year was roughly 2.23 million.

At first blush, one could argue that this bump up, which roughly translates to a 50 per cent increase, can be attributed to demonetisation. But it’s difficult to say for sure.

Part of the increase could simply reflect the natural increase in tax filings as a consequence of economic growth. Consider that in 2015-16, overall tax filings grew by 27 per cent as opposed to 22 per cent in 2016-17. In 2015-16, the increase over 2014-15 was of a similar magnitude: roughly 9.2 million.

While it is possible that individuals may have either filed their returns or beefed up their tax filings to account for higher deposits between November 8 and December 31, it is equally likely that part of these tax filings pertain to assessments year 2015-16 or before.

There are two ways to gauge the long-term impact of demonetisation on the tax base. One, by how much do tax returns go up this year and two, what is the increase in tax revenues.

On the first, data released by the income tax department show that of all the transactions analysed, 12.5 per cent of cash deposited was by those who have a PAN but have not filed their returns.

Arriving at an absolute number from this is difficult as the income tax department did not disclose the absolute number of PANs used in their report. The total number of PAN cards in the country is roughly 240 million but not all of them have been used in this analysis.

While it is likely that this may reflect in a bump up in tax filings, its impact on tax collections is not that straightforward. This is because the average cash deposited in these accounts during this period was a mere Rs 4 lakh which implies that many of these may well be below the income tax exemption limits.

The income tax department did not respond to detailed questions sent by Business Standard on the total number of PANs and cash deposits used in this analysis and on the increase in tax returns in 2016-17.

On the 'possible' unearthing of unaccounted wealth which could potentially boost government revenues, another data set released by the income tax department possibly highlights the extent of evasion still in the system.

Builders accounted for a mere 1.5 per cent of all cash deposits by businesses during this period. Further, the average amount deposited per PAN was a mere Rs 24.6 lakhs.

Contrast this to the white paper on black money released by the Finance Ministry in 2012 which said, “While the source of generation of black money may lie in any sphere of economic activity, there are certain sectors of the economy or activities, which are more vulnerable to this menace. These include real estate, the bullion and jewellery market, financial markets, public procurement, non-profit organisations, external trade, international transactions involving tax havens and the informal service sector.”

It further noted that “investment in property is a common means of parking unaccounted money and a large number of transactions in real estate are not reported or are under-reported.” Earlier estimates peg unaccounted money generated in real estate transactions in 2010-11 at roughly Rs 4 lakh crore alone.

Contractors and commission agents accounted for only 3 per cent and 1.8 per cent of cash deposits were by businesses, while traders accounted for a little over 60 per cent of deposits according to the tax department.

In other words, the clean-up is far from over.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)