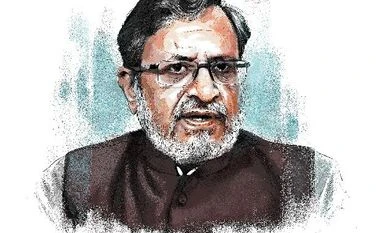

The Empowered Committee of State Finance Ministers was constituted to harmonise discussion and decision making on indirect taxes. Among its heads has been Sushil Kumar Modi, then and now the deputy chief minister and finance minister of Bihar. Now, however, he tells Dilasha Seth & Indivjal Dhasmana the panel is no longer needed. Edited excerpts:

Why are you saying the committee has lost its relevance?

It was constituted in July 2000. The decision was taken at a chief ministers’ conference to constitute a committee to implement Value Added Tax (VAT). The gazette notification and the terms of reference of the committee only mention issues pertaining to implementation of VAT; the committee played a historic role in this. In 2008, then (Union) finance minister P Chidamabaram requested it to prepare a road map for the proposed Goods and Services Tax (GST). A notification was then issued to give it a mandate regarding GST. Now, however, its role is over (with VAT gone, GST a reality and the GST Council the formally empowered body).

Can't it discuss issues related to the states' views on the new Finance Commission, the Union Budget or any matter outside GST?

That is not its mandate. GST is now to be discussed by the GST Council; all members of the empowered committee are its members. The Council has been mandated by the Constitution.

What will happen to the committee?

It should be dissolved; it is not needed now. The finance ministers are now meeting in the GST Council. Besides, the committee’s tenure is only for a year.

Aren’t small and medium enterprises (SMEs) still facing issues under GST?

There are, for small industries and textiles. As much as 80 per cent of issues related to tax rates have been resolved. The remaining 20 per cent would be. SMEs should give proper presentations to the GST Council. The issues related to this sector are on simplification of processes.

And, the (underlying) information technology (IT) should be more user-friendly and interactive. As many as 40 per cent of tax filers have zero tax liability but also go through the entire format of returns. We have now started previews and editing facilities, not available earlier. A new committee under GST Network (GSTN, the IT backbone for the system) Chairman A B Pandey has been set up for simplification of forms. The idea is to make all returns and forms simpler. Traders are not tech-savvy and are finding it difficult to file by using computers. As more issues come, we will resolve it, be it SMEs, small traders or textiles.

Has the committee chaired by you to fix issues related to GSTN resolved the problems?

We had identified 47 functionalities to be created or improved. Most of the timeline have been maintained and many things resolved. It takes time to improve things after 37 tax jurisdictions are integrated into one.

Business is scared of the anti-profiteering mechanism. Was that needed?

If a consumer won't get the benefit when a tax rate is reduced, why should action not be taken? This should reflect in the final prices. Business should not be unnecessarily afraid.

Exporters have complained that their GST refunds are still stuck.

Refunds for Integrated GST are now being given online. Input tax credits and other refunds could be applied for online but matching of input and output has become difficult, since filing of GSTR-2 has been stopped. Also, a number of errors have been detected in terms of invoice numbers, shipping numbers, etc. These are procedural issues. However, tax credits and other refunds are being expedited and the situation is quite improved now, compared to what it was.

You said petroleum should be included in GST. Will states be allowed to impose tax on petroleum over GST?

Petroleum products account for 40 per cent of state revenues. So, over and above the GST rate, the Centre or state should be free to levy additional tax. This is a general principle for petroleum through the world. This will ensure companies will at least get input tax credits. However, bringing petroleum under GST might take some time. The objective is that revenue does not get affected.

Will real estate and electricity also be brought under GST?

This will be discussed. But, first, GST in its current form needs to stabilise. Complaints against GST have reduced compared to the first three months.

Some states complain of revenue shortfall under GST. What is the position of Bihar?

There was 52 per cent revenue shortfall in the first couple of months of rollout (which began July 1). That has narrowed to 41 per cent.

How much hit has the Bihar exchequer taken due to (liquor) prohibition? Was the step necessary?

There is an impact of Rs 4,000 crore (yearly) on revenue but the decision has helped a lot on the social front. Crime against women, road accidents, eve teasing, etc, have seen significant reduction. People are very happy with this decision; there is peace at home. Even earlier, the level of liquor consumption in Bihar was much lower than in eastern or northern states.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)