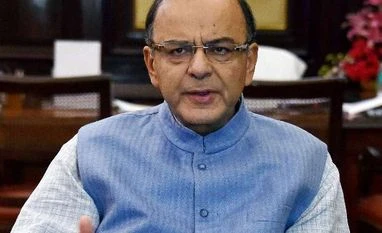

Finance minister Arun Jaitley on Wednesday hinted that he might blunt the impact of tax on withdrawal from employees' provided fund (EPF), after the Budget proposal drew flak from the middle class.

There have been some reactions when debate comes up in Parliament, I will give the government's response as to what decision we finally take," Jaitley said in his post-Budget interactions with chambers.

He said that the Budget and the Finance Bill are a matter in which, as a matter of propriety, Parliament has the first right to know that the government is treating some of those suggestions.

On Tuesday, a government statement had said that the finance minister would consider the demand for limiting tax on 60% of total withdrawn funds only on returns earned and not principal.

The Budget has provided that 40% of withdrawn funds from EPF would not draw any tax. However, if the remaining 60% is withdrawn lump sum, then there would be tax. If the remaining 60% is converted into annuities and the person concerned gets regular pension, then also there would not be any tax on withdrawn funds.

"The intention is not revenue generation. That is not principal intention here," Jaitley said.

Commenting on the intention behind the move, the finance minister said that from last year onwards he had been repeatedly saying that we want India to become an insured society which gives pension to its retired citizens.

More From This Section

He also explained that EPFO has around 3.70 crore members, about 3 crore of which have earning capacity of Rs 15,000 or below. For them, there is no tax liability.

"It is only private sector employees on whom there is an impact. And the object was that if to meet your various commitments you can withdraw up to 40%, you need not pay tax. The balance is converted into annuities, you get a regular pension and you don't pay tax," he said.

This is intended to incentivise people in the private sector to use it as a kind of pension and to disincentivise those who would otherwise indulge in consumption of that fund.

)