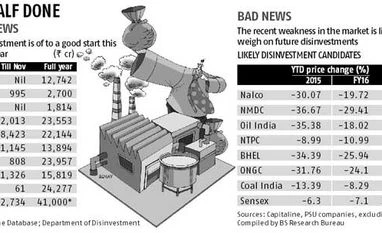

The government has raised Rs 12,700 crore through disinvestment in public sector undertakings (PSUs) in the first eight months of the current financial year (FY16). This is the second-highest amount ever raised by a government in the April-November period.

This, however, is likely to be of little benefit to the Narendra Modi government, as a recent rout in the commodity market has impacted the stock prices of likely disinvestment candidates.

The Centre had raised Rs 18,460 crore in the first eight months of 2010-11 and went on to raise Rs 22,144 crore for the entire year.

In the remaining four months of FY16, the government faces an uphill task of raising Rs 28,000 crore if it has to meet this year’s PSU disinvestment target of Rs 41,000 crore.

The shares of most disinvestment candidate, including Oil India, NMDC, ONGC and BHEL, have declined by around 30 per cent so far this calendar year, compared to a six per cent fall in the benchmark Sensex.

“Global deflationary concerns are putting pressure on the prices of all resource companies - be it oil, coal or metals. Not even a single resource company has got spared. It would be a wrong time to even think of disinvestment in these companies given the amount of correction,” said G Chokkalingam, founder, Equinomics Research & Advisory.

Most global commodity prices have slumped to multi-year lows due to fears of a global slowdown. The weakness in the prices has in turn weighed on the share prices of metal and resource companies.

The government is also cognizant of the slump in stock prices of the some PSUs. “I don't think it makes sense divesting at a time when prices are low,” Finance Minister Arun Jaitely said at a recent conference.

Experts believe the revival in commodity stocks could be some time away. “On metals, we are not taking a bet on pricing. We think prices might not improve, but there is scope in some names, where a volume increase could play out over the next two years,” said Anant Shirgaonkar, head of India equities at UBS.

Chokkalingam believes it would take between six and 12 months for a recovery in commodity stocks. “If it doesn’t happen this time, then we might be staring into an even bigger problem.”

Worryingly for the government, most PSU entities are resource companies, which have borne the brunt of the meltdown in commodity prices. Notable state-owned entities that have managed to outperform the market this year are oil marketing companies (OMCs). Drop in oil prices, coupled with deregulation of fuel prices, have seen OMCs like HPCL, BPCL and Indian Oil outperform the market. However, there isn’t much leg room for the government to pare its holdings in these companies as it’s slightly above the 50 per cent levels. In August, the Centre had divested 10 per cent stake in Indian Oil Corporation to raise Rs 9,400 crore.

Fortunately, the shares of Coal India, which is likely to be the biggest disinvestment candidate for the current financial year, haven’t cracked as much as other resource companies. The scrip of Coal India is down around 13 per cent, but trades below last year’s disinvestment price.

This, however, is likely to be of little benefit to the Narendra Modi government, as a recent rout in the commodity market has impacted the stock prices of likely disinvestment candidates.

The Centre had raised Rs 18,460 crore in the first eight months of 2010-11 and went on to raise Rs 22,144 crore for the entire year.

In the remaining four months of FY16, the government faces an uphill task of raising Rs 28,000 crore if it has to meet this year’s PSU disinvestment target of Rs 41,000 crore.

The shares of most disinvestment candidate, including Oil India, NMDC, ONGC and BHEL, have declined by around 30 per cent so far this calendar year, compared to a six per cent fall in the benchmark Sensex.

“Global deflationary concerns are putting pressure on the prices of all resource companies - be it oil, coal or metals. Not even a single resource company has got spared. It would be a wrong time to even think of disinvestment in these companies given the amount of correction,” said G Chokkalingam, founder, Equinomics Research & Advisory.

Most global commodity prices have slumped to multi-year lows due to fears of a global slowdown. The weakness in the prices has in turn weighed on the share prices of metal and resource companies.

The government is also cognizant of the slump in stock prices of the some PSUs. “I don't think it makes sense divesting at a time when prices are low,” Finance Minister Arun Jaitely said at a recent conference.

Experts believe the revival in commodity stocks could be some time away. “On metals, we are not taking a bet on pricing. We think prices might not improve, but there is scope in some names, where a volume increase could play out over the next two years,” said Anant Shirgaonkar, head of India equities at UBS.

Chokkalingam believes it would take between six and 12 months for a recovery in commodity stocks. “If it doesn’t happen this time, then we might be staring into an even bigger problem.”

Worryingly for the government, most PSU entities are resource companies, which have borne the brunt of the meltdown in commodity prices. Notable state-owned entities that have managed to outperform the market this year are oil marketing companies (OMCs). Drop in oil prices, coupled with deregulation of fuel prices, have seen OMCs like HPCL, BPCL and Indian Oil outperform the market. However, there isn’t much leg room for the government to pare its holdings in these companies as it’s slightly above the 50 per cent levels. In August, the Centre had divested 10 per cent stake in Indian Oil Corporation to raise Rs 9,400 crore.

Fortunately, the shares of Coal India, which is likely to be the biggest disinvestment candidate for the current financial year, haven’t cracked as much as other resource companies. The scrip of Coal India is down around 13 per cent, but trades below last year’s disinvestment price.

)